Sprawlhaven, Florida: Suburbs In The Age Of Climate Change

I’m walking by a vacant lot along a major arterial in Fort Myers, Florida. The grass strip by the curb is piled several feet high with a mess of dead branches, palm fronds, and brush, the occasional anthropic item like a dresser or appliance providing an elegantly angular contrast with the tangled messes of sticks and twigs. It’s a sight to which many residents of the Gulf Coast are inured. In the aftermath of Hurricane Ian, it’s pretty ubiquitous in Southwest Florida, which was hammered by the Category 4 storm, but it’s inevitably going to get far worse as the state continues to take a laissez-faire approach to growth management and weather becomes more intense and more unpredictable. Two weeks ago, I got some firsthand looks at land use management– or, generally, a complete lack thereof- and how it has transformed Lee and Collier Counties in Southwest Florida and their surroundings, especially as this part of the country is increasingly threatened by severe storms and an inability of the public sector to manage them through the built environment. The insurance industry is also complicit. It’s a mangled mess, like the ones I’m inspecting on the streets of Fort Myers.

A Recent History of Unchecked Growth

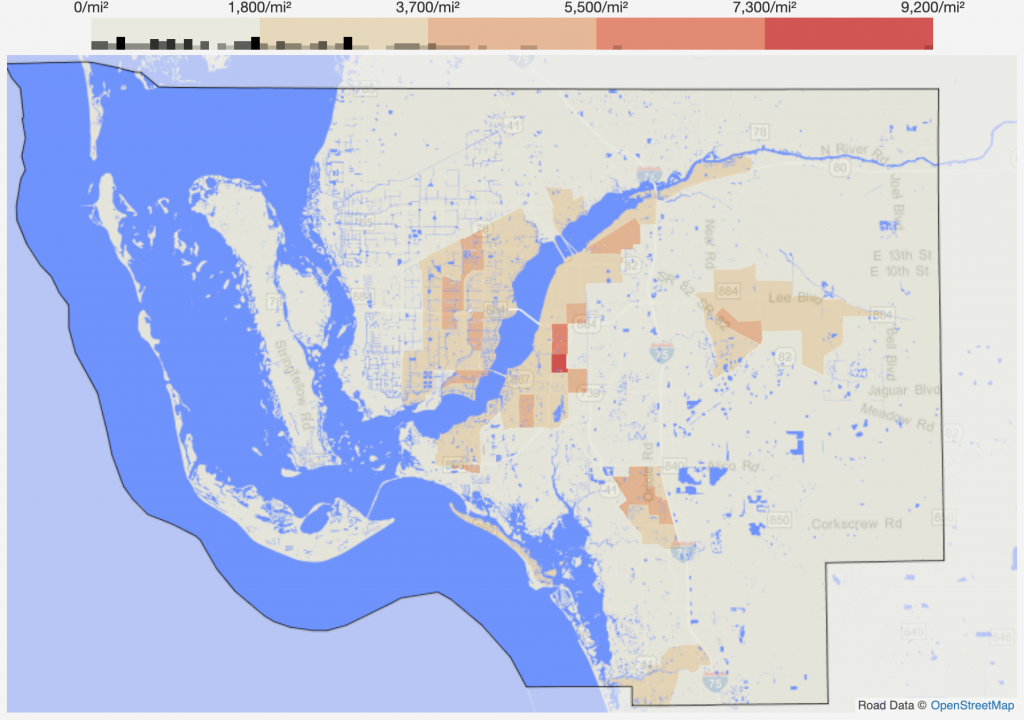

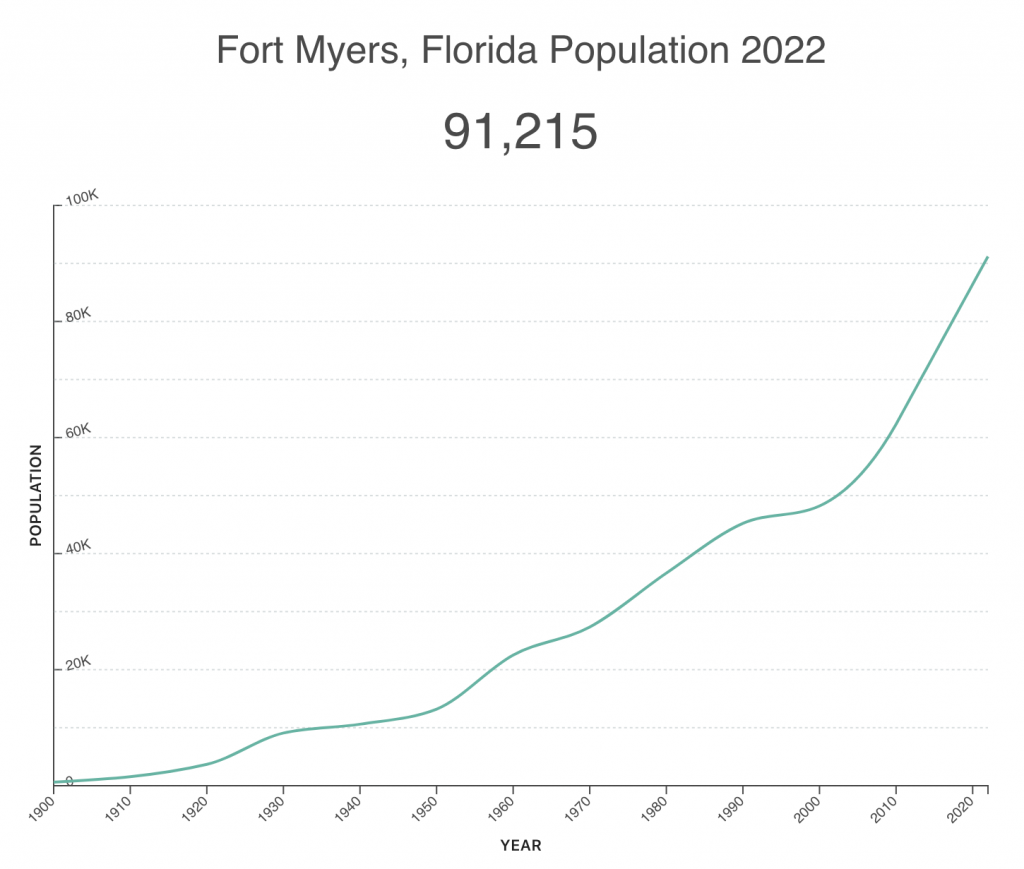

The very term “growth” has been inseparably entwined with perceptions of the Sunbelt for the past generation plus. Lee County has enjoyed explosive growth in the past 30 years (127%, 1990-2020), easily beating out growth rates of coastal Charlotte County to the north (68%) and Monroe (6%), farther south, which substantially comprises the Everglades (where development is limited because of environmental protections) but also the Keys (where development is substantially spatially constrained). Miami-Dade, the state’s most populous county and home of the largest real city in the state, has grown quite a bit slower (39% over the same time). South of Lee, Collier County, home to Naples and Immokalee (of Road Fame), has grown by 147% over this time frame.

The region is defined by gridded roads that are often six lanes wide at a minimum. Traffic backs up sometimes for miles, and Fort Myers increasingly ranks in the top most congested areas in the country. Public transit is limited, and politics plays a key role in a state where Fox News Kool-Aid guzzlers believe that taking an hour to drive a mile in traffic equates to “freedom” and paying a penny on every dollar you spend for public transportation amounts to communism. Congestion mitigation efforts seemed nonexistent on my visit, but there are plenty of Brand New Chevys With A Lift Kit that are more than happy to rev their engine at you and scream obscenities when you are observing traffic laws and they have somewhere to be. (This happened a few times in a week).

So, this is a cultural problem more than it is a political or infrastructural one, but it’s one we should mention as part of the state’s grim near-term future facing climate catastrophe.

Of course, sprawl or condo tower, people do need somewhere to live, and we have all heard takes good and bad on the national housing shortage. But this isn’t simply development, it’s development of a particularly egregious character, often expanding out into former swampland, savannah, forest, or other greenfield space, accompanied by ample surface parking. This is the kind of development that “not only amplifies natural hazards but reactivates dormant hazards and creates hazards where none existed.” Wesley Marx was writing about Southern California in 1977, but the same sentiment holds for Florida in 2022. It’s valuable for us to not only recognize this but also to figure out how it came to be quite this bad.

Advocates for better planning in the 1970s and 1980s lobbied to create what became known as the Florida Department of Community Affairs in 1985. Republican Governor and now United States Senator Rick Scott abolished the agency in 2011, claiming that it was a good example of government bloat, all government is bad, blah blah blah. Be it said: anyone who agrees with him might also consider that governmental oversight might have prevented the bazillion-dollar medicare fraud that his company perpetrated. The DCA wasn’t the be-all, end-all of good or bad development, to be clear. But it did have an important role that has now been relegated to communities eager for new tax revenue and feathers in their caps.

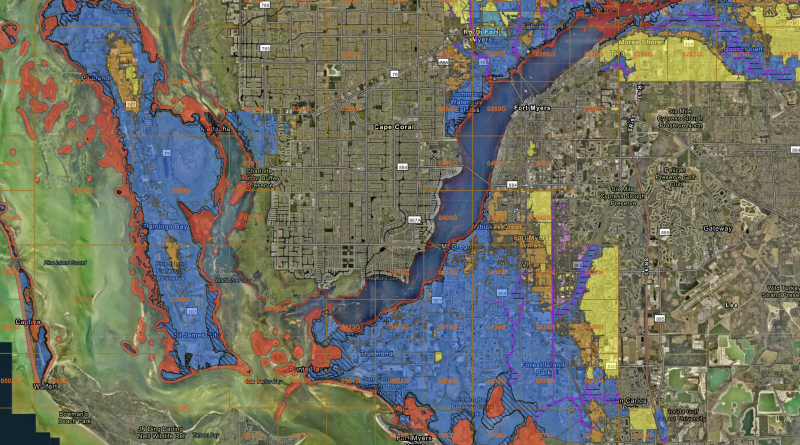

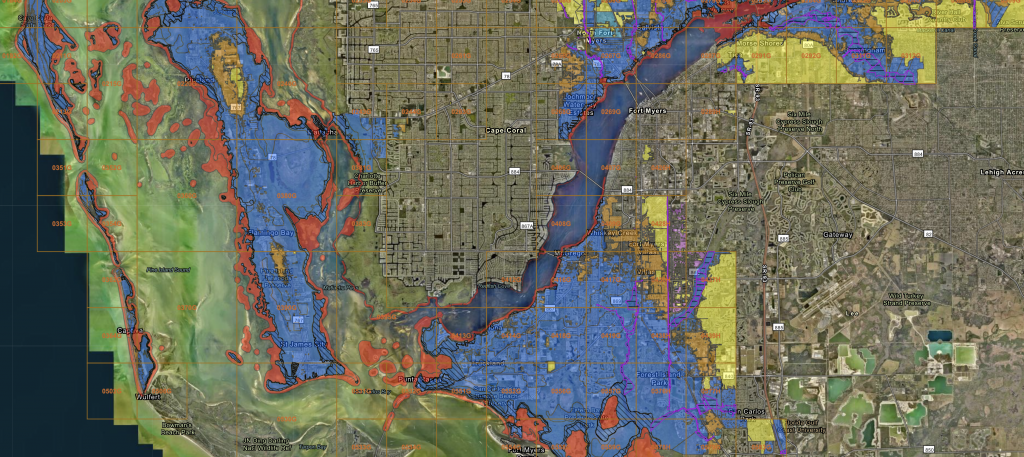

The FEMA flood map above shows that a lot of development isn’t inside the worst flood zone. But that doesn’t mean these places are immune to damage. Some of this seems to be happening on a neighborhood-by-neighborhood basis. The most common debris I saw was sticks, leaves, and tree branches. But if you traveled the city by a one-mile grid, street by street, you’d be hard pressed to find an area that didn’t see insane levels of damage. One of the worst neighborhoods we toured was actually just north of the orange and blue areas, sort of center-right in the map, just along the Caloosahatchee River. While many residents were around to clean up, it was clear that this was going to be a long process– garages voided of their contents, appliances littering the streets of a suburban neighborhood where the average home price probably started in the three or four hundred thousands.

Is it even possible to rein in this development paradigm, even after seeing how badly it’s playing out in the age of climate change with storms like Ian?

I remember getting into a debate over the growth mandate a few years ago with a colleague and dear friend. “Well, the township’s gotta grow,” he said. “No,” I replied, unequivocally, “the township does not have to grow— especially if that growth is simply by greenfield development.” Do people have to live somewhere? Yes. I’d even say that they deserve a place to live, because I’m a bleeding heart communist! Now, must they live in semi-detached single-family housing in the distant suburbs? Definitely not. Do they have to live in this former swamp, paved over with crushed rocks mixed with crude oil, and pay twice the national average for insurance because local municipalities and state governments can’t figure out how to regulate? Also– you guessed it- no.

A Sprawl Eternal vs. The Insurance Industry

One certain thing from the aftermath of Ian? The complete upending of an insurance market already roiled by nationwide catastrophes. The insurance industry is notoriously conservative and notoriously slow-moving. Policy advocates have argued that they’re indeed moving way too slow to combat the effects of climate change. They could do this by incorporating climate risk into their modeling. They could also attach terms to policies, as is common with programs like FHA– requiring certain standards of energy efficiency, for example, which would contribute to decarbonization, or requiring certain mitigation measures to reduce the risk of catastrophic storm damage.

We are seeing a nationwide trend of insurance companies dropping coverage of areas threatened by natural disasters, whether hurricanes on the Gulf Coast or wildfires on the West Coast. As the private sector backs out, the public sector is forced to pick up the tab. Is this responsible? Equitable? Absolutely not. But it’s inevitable. It wouldn’t be the first time that state or federal governments have had to step in to pick up the tab for damages, or even to prop up an ailing market for something as nebulous as insurance. Floridians already pay sky-high rates of insurance.

Perhaps most ironically? Industry experts say that fraud and litigation, not climate change or storms per se, are substantially responsible for driving up costs. This is a great example of how a complete lack of regulation combines with the unpredictable effects of climate change and poorly planned urban development to, well, screw everybody– the taxpayers at large, homeowners who lose their houses or suffer massive damage, and the markets supporting homebuilding, real estate development, and insurance.

Think this is bad bad? It gets even spicier!

The state of Florida seems unlikely to pick up the tab on hurricane damages. Ron DeSantis has touted his efforts in facilitating recovery and cleanup, but the amounts involved in the state funding are middling at best compared to the tens of billions of dollars in damages. This means that the federal government will have to inevitably step in. And if this happens, this means that the Big Socialist Federal Democrat Marxist Socialist Baby-Eating George Saros [sic] Government will be forced to assume billions of dollars in costs to cover poor land management practices.

This is, by some estimations, what the insurance industry is going for. If they get to a point where they can’t charge as much money as they want to for insurance policies, and, indeed, if they end up being bankrupted by insurance claims from a major storm like Hurricane Ian, which is set to be perhaps the second-costliest hurricane in US history, they can simply beg for a bailout from the federal government. Again, this is coming after they have refused repeatedly to include climate risk in their financial modeling, and have done little to encourage better development practices.

Policy Solutions For A Florida, If Floridians Want Florida To Exist

If Florida is interested in, well, existing in twenty years, it would do well to develop aggressive and broad strategies to harden infrastructure, require the insurance industry to encourage more climate-resilient, lower-footprint, lower-carbon development, and, oh, how about decarbonizing the state’s economy? While public utilities in the Sunshine State have made big moves toward utility-scale solar, distributed generation was virtually nonexistent as little as a few years ago. And we are unlikely to see much new investment related to resiliency, climate adaptation, or decarbonization with the reëlection of Ron DeSantis and Marco Rubio. DeSantis referred to decarbonization as “left-wing stuff,” according to Time, while Rubio is on the record dozens of times as having denied that humans have anything to do with the changing climate.

DeSantis, for his part, has actually invested state funding in hardening of infrastructure. This perhaps doesn’t translate to better development paradigms in the absence of better oversight or planning mechanisms. But it is at least gesturally significant. It’s also politically savvy for a guy who is frankly overeducated enough to know better but has to also cater to people who love his boisterous bullying of the dirty libs– meaning, he can do climate-related stuff without talking about it as climate-related. It’s not terribly clear whether he has any ideas on how to solve the insurance problem, but this is something I’m following as it evolves. In the meantime, insurers face billions of dollars of payouts over more than 600,000 claims. The total tab of damages, public and private, could peak at as much as $60 billion.

Meanwhile, as I’m about to publish this, a friend in West Palm Beach sends me an article about Miami considering expanding its urban growth boundary. Developers want to build on greenfield space near Miami. It’s a region that, like Fort Myers, has appallingly bad traffic and, you know, floods pretty disastrously every time there’s a hurricane. Hey, I’m getting déjà vu. Come on, Florida. You’re almost there! I can feel it! Let’s start talking about how to solve these problems, bring industry stakeholders together, create sensible regulation to encourage everything ranging from better insurance policies to better land management practices and, of course, rein in the sprawl-happy development paradigm. There is plenty of good stuff in Florida. We owe it to the state’s wealth of natural beauty and its demographic vibrancy to build it better.