EV Charging Networks: Drive Infrastructure, Not Just Cars

A few weeks ago, I had a chat with some folks from A Major Automaker, one of the Big Two-And-A-Half, to talk about their growing electrification program. The automaker is going in big on electric vehicles, and needs to figure out what public EV charging networks are going to look like. This is a matter of making sure that networks are well-developed to ensure that prospective car buyers feel like they have enough options for charging. Their idea is that EV charging networks will drive sales. But I don’t know that this is the right way to think about the changing market for US cars. I’m definitely not sure this is the right way to think about transport electrification.

What’s Holding Electric Vehicles Back?

Range anxiety? Not so much anymore, in the bevy of new cars that can crack 200-mile (320km) range without breaking a sweat. (Or whatever the inanimate object, machine equivalent of sweat is). Arguably the biggest thing is not the lack of development of EV’s– the Bolt was rather well-reviewed overall- but the fact that US automakers (excluding Tesla) have really dragged their feet on marketing. This is why GM had a fire sale on Bolts earlier this year, which wrapped up a bit owing to that whole chip shortage thing as availability of stock waned. Dealerships were practically giving cars away, marked down from $45,000 MSRP to as low as $21,000.

Still, there’s an idea that EV charging network will drive sales. But there’s a challenge to figuring out how to develop especially public ones. Where should we prioritize development? Within transportation corridors? For homes? Offices? Parking garages? Strip malls in Macomb County?

Every Charger Its Own Context

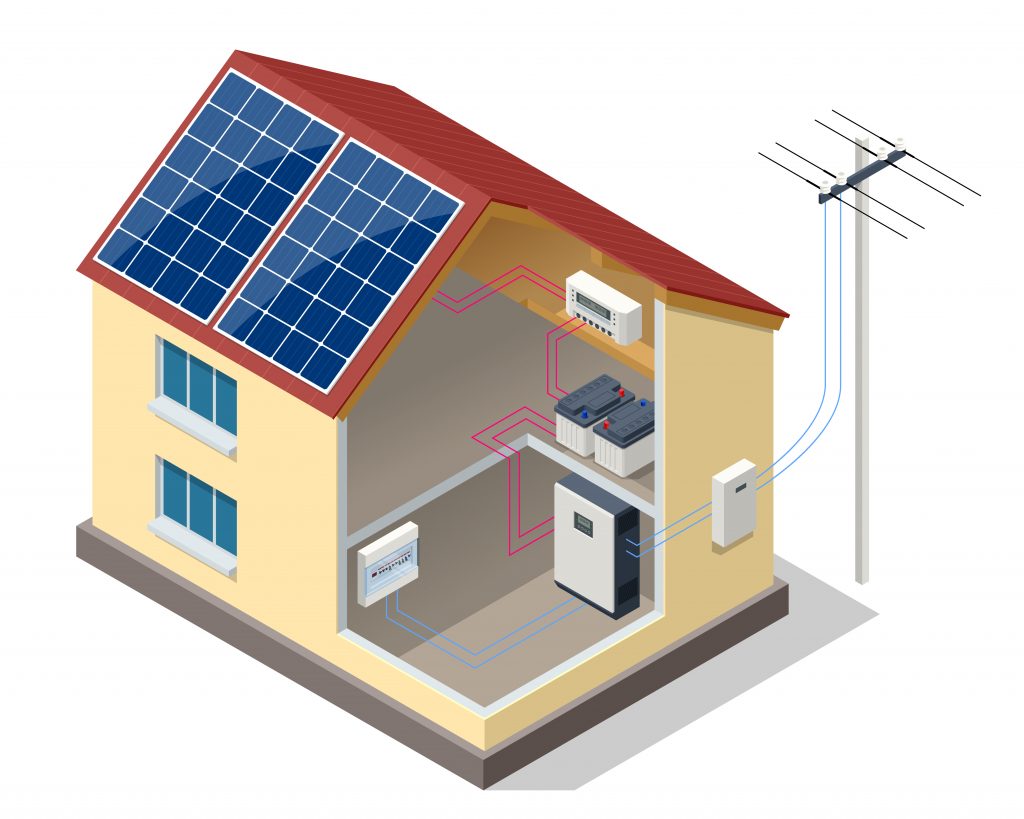

In The Home: Home charging is a no-brainer. Your car spends most of its time parked at your house. This means, with few exceptions, you can use a slower, lower-capacity charger. Challenges to home charger scaling include that many homes lack sufficient ampacity to install more than a Level 1 (slow) charger. This is a huge issue if you own a smaller, sort of “starter home” from the earlier half of the 20th century. A small, 1920’s bungalow with most of its original wiring might have a 40-amp electrical service. The 20th century saw a migration more toward 100-amp electrical service and even 200-amp service in larger homes by the turn of the new millennium as residential square footage ballooned from the 1000’s and 1500’s in the midcentury to closer to the upper 2000’s in the current era of suburban glory.

Mispricing the Chevrolet Bolt, And Other Strange Corporate Decisions

Today, while homes aren’t getting any larger, electrification means that we’re not only going to need a 60-amp breaker for our mini-split, we’ll also need a 60-amp breaker for an EV charger, a 40-amp breaker for our electric dryer, maybe another 40-amp for the stove. Ohm-y! (I’m sorry, it was… just right there). That’s a lot of amps. In other words, 300-amp is going to be the new 200-amp for electrical service.

But this isn’t what the automaker is concerned with. Rather, they’re worried about what you’re going to do when you’re out of the house. Most people, they say, drive from their home to, say, a suburban office park, a strip mall, a supermarket, or whatever. Let’s make it so they can charge it there! Home charging, they think, is something that people will or won’t opt into if they can afford it. They think, rather, that public EV charging networks will drive sales. I’m not convinced we’re thinking about this the right way, so, let’s look at this from a few different angles.

Idea 1: Networks Drive Sales

The driving force, pun intended, behind an automaker developing EV charging networks, is that people will buy more cars if they know that there are places to charge them. In other words, EV charging networks drive car sales. This is how gas stations work. You drive places and you can stop basically anywhere and buy gas.

Any B-school graduate will be familiar with the perennial, challenging question of whether a company should do such-and-such in-house, acquire a company that does such-and-such, or partner (contract) with another company to do it. There are tradeoffs for each one. (You can save the cost of the mail-order MBA that I acquired at no small expense and just read this blog).

Do It In-House vs. Acquire vs. Partner

Here’s the general overview of how it looks from the corporate perspective:

| Advantages | Disadvantages | When To Do It | |

| Do The Work In House (in-source) | – Often more marginally (per extra unit of [x]) affordable in the long term, once the team is built | – High cost to build team; threat of objective creep – Possibility of high overhead over long-term – More financial risk if the project goes south | – When your investment in something is long-term enough that you don’t mind having a bunch of people on staff who are really excellent at doing whatever it is you’re trying to do. |

| Acquire A Company (that does this thing) | – You’re buying the expertise without having to figure out how to train people to do a thing you might not know how to do in the first place | – Acquiring a company can be a really obnoxious and expensive process – Valuation is a notoriously challenging thing to understand | – When you’re committed to doing this thing, but you also want to allow some level of separation from your acquired company so it can retain its independent mojo (Cruise’s engineers are not about to move to Michigan, let’s be real) |

| Contract with a company (that does this thing, often called “partnership”) | – Ideally the best of both worlds; allows a straightforward enough costing framework and helps build capacity without a massive amount of risk or learning curve | – Typically more expensive, especially if the contracted company is “lending” direct staff to work on the project – Major challenges of controlling costs – Limits possibilities of doing things in-house in this same space (i.e. anticompetitive, though that didn’t stop Cruise from competing with Lyft within the aegis of GM) | – When it’s necessary to execute something faster than an acquisition would allow, but you’re not sure how committed you are to the thing long-term |

The problem with the above chart? Giant companies tend to make really bad costing assumptions when it comes to figuring out ways to contract out to scale stuff. One of the people I talked with told me that it’d cost him $5,000 to double the capacity of his electrical panel to 200 amps, which would allow for a Level 2 charger for an electric car. I’m thinking he should get a new electrician at this point. This is a day of work for a skilled worker and a few hundred bucks in materials.

The Coming Electrification of the North American Economy

Idea 2: Networks And Infrastructure Drive Each Other

This is the next tier in the galaxy brain. We’re no longer talking about facilitating the development of EV charging networks to sell cars. We’re instead thinking about how infrastructure innovation will drive EV sales, and EV sales will, in turn, drive infrastructure innovation. I don’t think that the power grid of 2050 involves a hefty reliance on local distributed power generation in the form of people’s electric cars selling power back to the grid during peak times. It’s perhaps a bit unrealistic. But the point is that setting up the system to work like that would be enormously valuable.

Why?

The power grid currently comprises gigantic transmission lines and gigantic power plants. That’s valuable in some ways. But it also allows for a lot more things to go wrong a lot more often. Our neighborhood’s power was knocked out last year because a train derailed and smooshed a single power line– nowhere near our house. Like. Really? Imagine a system that instead had multiple points of interconnection. Now, on top of that, imagine a system where a bunch of electric cars could sell power back to the grid during peak times. It’s not a power generation strategy. But it’d be a helluva backup in case, well, things went very wrong.

Hey, let’s be real. Upgrading our ailing power grid isn’t even going to be that expensive. What it will be, however, is extraordinarily valuable in replacing fossil fuel infrastructure. The future of electric cars doesn’t involve driving out to the suburban Whole Foods built on greenfield space with TIF money just so you can charge your F150 or whatever. Nay, the future is more like, replacing our massively overbuilt, fossil fuel infrastructure, with electric infrastructure. Every interstate highway is flanked by gas stations. Every garage bears the faint reek of gasoline and oil. Why shouldn’t both involve, say, photovoltaics? And maybe battery storage, too?

This is where the automakers need to place their efforts. Retooling their lagging model of MOAR TRUCKS is going to require some outside-of-the-box thinking. Outside of the cage, one might say. In this case, the things that are holding back prospective EV buyers aren’t the lack of suburban, public EV charging networks– it’s more like, well, the fact that automakers can’t figure out how to market or sell an affordable EV.