Detroit Park City, No. 2: West Larned (2/52)

Any effort to address the Motor City’s glut of surface parking might well start, ironically, downtown.

At the risk of becoming a broken record, I’ve often tried to explore the economic and geographic realities that negate the oft-repeated tropes of “Downtown: It’s Coming Back!” or, as a young man at the Shinola store told me the other day, “Now, with the QLINE, you don’t need to own a car anymore!” Downtown’s population density is low, Midtown’s population density is low, and inner ring midcentury suburbs Eastpointe (formerly East Detroit before they rebranded in 1992), Harper Woods, Lincoln Park, and St. Clair Shores have a higher population density than both. (I know- yada, yada, yada, density something something.)

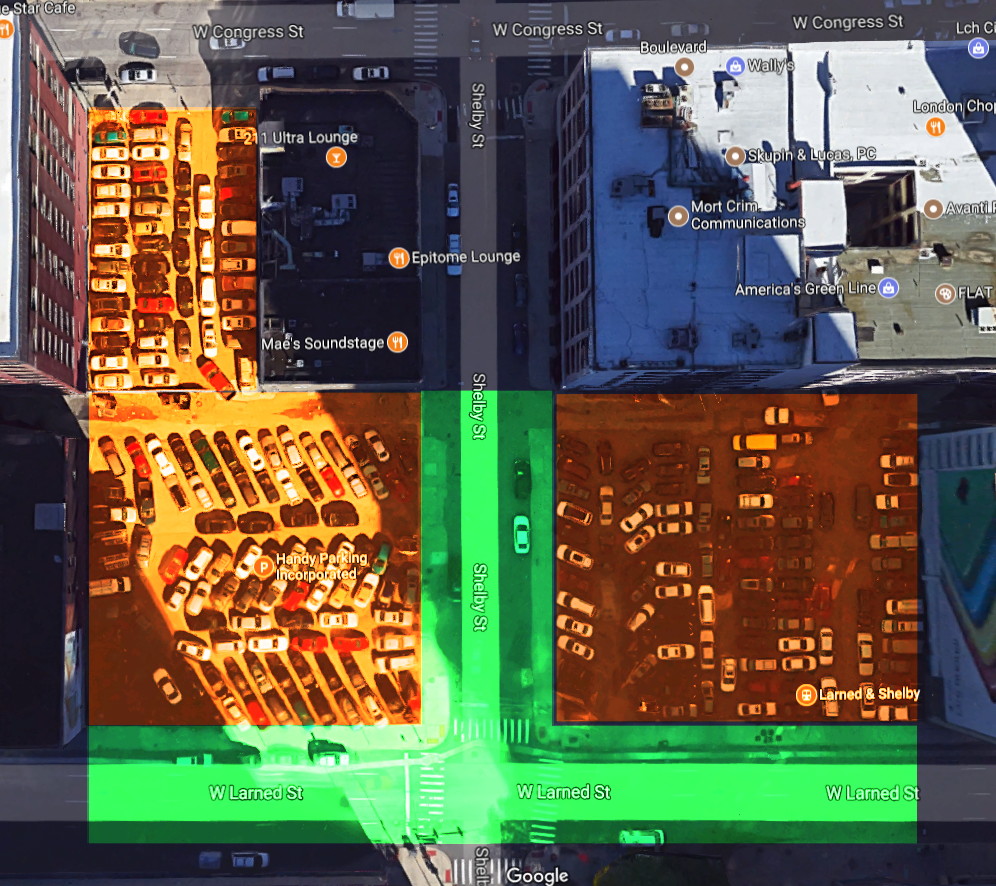

In particular, the corner of Shelby and Larned stands out as a crater of parking in the center of a canyon of buildings. I thus bring you Detroit Park City No. 2.

EXPERIMENT: QUANTIFYING THE VALUE OF PARKING

In my first post, I spent some time thinking about one particular assumption of Donald Shoup about the monetary value of a parking space: While average car prices have been climbing in recent years, the actual value of the average car that is parking in the average parking space may often be, Shoup suggests, less than the cost of the parking space itself. This is going to be more financially problematic than in my previous post about the Mexican Village lots, where prices are stable and rapidly increasing, but density is still quite a bit lower. Downtown, prices are high, so there is no such thing as a free parking-lunch.

A particularly large, but nonetheless single, parking space in New York City, for example, made headlines after it was offered for sale in a new luxury condo building for– wait for it- $1 million. (If a bank would allow you to tack that onto a loan, that’d add about $4,000-4,500 a month for your mortgage P&I, so, get a second full-time professional job to pay for the parking space.)

Since New York breaks all rules, as the self-described center of the cosmos around which all of us aspirationally orbit, how to actually quantify the value of parking in, well, real places? From an appraisal standpoint, the easiest way would be to compare comparable sales or appraisals of two identical units, one with parking and one without. Outside of the frankly rare opportunity to compare two units that, aside from parking, are identical, Detroit demonstrates that the notion of appraisals, which should theoretically mirror market value because they ostensibly justify financeability, are kind of bogus because they do not at all equate to market value. But, in the rare event that you could find identical units, you could definitely answer this question (for one limited “comparable”).

On the other hand, this value model doesn’t work in aggregate or for large lots serving as event parking rather than, say, apartment parking, so maybe we can look at revenue-generating potential. It’s difficult to develop something like a cash flow estimate for something with such a heavily-tiered structure whose tiering is dependent upon somewhat unpredictable demand, and whose ownership is tightly controlled (and therefore whose information is also tightly controlled). If pricing isn’t real-time, how do the owners determine demand?

Ted Anglyn from Parking Today (yes, that’s a real thing) explains:

“For a parking structure income analysis, an appraiser has to forecast the revenue to be generated by the facility, the likely supply/demand (occupancy), the cost to operate the property, and how the market will convert that property’s income stream into a supportable value indication.”

Sounds sufficiently vague, Ted! The likely supply/demand? Anglyn continues:

“Most appraisers will request three years’ operating statements, the profit-and-loss summary for the current year, copies of lease contracts, lists of parking rates, a budget and a capital improvement summary. The appraiser also will need to survey market conditions to support revenue and expenses.”

So, essentially, someone built on someone else’s lessons as far as how much money they knew they could make, and they came up with… (drum roll)… a six-tiered pricing system. This kind of pricing scheme is rare in business. Markets for most mass-produced goods are well-defined based on labor inputs and demand, and it is generally fairly easy to approximate the market value of, say, durable goods, or everyday consumable products– whether water heaters or bags of chips. Airline price discrimination, for example, exists, but it is opaque– you never really know when or why your price went from $467 on Monday morning to $643 Monday afternoon.

(The owners of record for these lots did not respond to a request for comment.)

(The owners of record for these lots did not respond to a request for comment.)

THE SITE

This intersection features three parking lots over five lots which are all privately owned, interestingly, by separate owners. Are the lots leased to a common parking operator? Two appear to be operated by the same owner. Based on photographic records I looked at, these sites have been without buildings since the mid-1960’s or earlier but were likely (at some point) occupied, so it stands to reason that the foundation upon which the pricing model I referred to in Anglyn’s quote above has been well-developed over decades. Parking lots designed for high-demand areas with rigid 9-5 commuters often allow for increased efficiency, because operators can park cars tighter (think– no “in-out” privileges because it’s not spatially possible). The theoretical spatial maximum of this site (square footage divided by 162 square feet) would yield 271 spots, not much more than the 239 I counted, so, nearly double the efficiency of the Mexican Village lots. I can’t really call this “optimization” so much as I can call it “smooshing cars in since the operator knows that the driver will only be coming out to claim the car at, say, 5-6pm, but it is notable.

While not only betraying an understanding of these parking lots as proud monuments to strained stormwater infrastructure, the surroundings bear some glorious architectural gems. The Banker’s Trust Building at the southwest corner of Shelby and Congress, built in 1925 and designed by Wirt Rowland (with Smith, Hinchman, and Grylls, the great-grandfather firm of SmithGroupJJR), has variously hosted a bank (shocking, I know), various office tenants, and even a McDonald’s, once upon a time. The building, sold at auction in 2015, currently hosts a venue, Epitome Lounge, that could be perhaps aptly described as “da club.” A façade designed by then-25-year old Corrado Parducci, an Italian architect and Robin to Wirt Rowland’s Batman, remains largely intact. Though at that time firmly chillin’ in the Beaux-Arts style, Parducci would in the next few years go on to design the Art Deco masterpieces of the Penobscot Building (1928), the Guardian (1929), and the Theodore J. Levin U.S. Courthouse (1934), sometimes even merging the styles in a tremendous, Beaux-Arts-Deco Mashup, all within a couple of blocks of this location, west of Woodward Avenue and South of Michigan Avenue.

LESSON: GO UP, YOUNG MAN

As the average height of high-rise buildings in the surrounding block is 17-18 stories, I proposed roughly matching these building heights if not pushing that density higher. As we’re getting fairly tall there, that allows us some more room to play around with what we need to meet some general parking requirements, whatever they are: I’ve proposed building an underground parking garage that actually goes under the street, occupying the majority of both lots. Rare is it that a development project will come along allowing full, ground-up development of two parcels of downtown real estate, so, let’s go the whole hog.

Densifying a real estate development project is, of course, a no-brainer (within reason). Your land acquisition costs are the same regardless of whether the finished product will be a strip mall or a skyscraper (illustration below). This may be a “duh” moment, but it’s not surprising that single-story homes dominate low land value areas (the distant burbs, or, much of Detroit), while the highest density areas are often the highest-priced. (Exceptions are few but notable– a handful of extremely wealthy suburbs in most major metropolitan areas, and much of the Bay Area, which, in the spirit of traditional Californian paradox, has crazily low density and crazily high demand, borne of the suburban Silicon Valley ethos.)

Residential construction techniques for a building that is one to maybe four stories will all generally be the same and, in these parts, rely on stick framing, while higher-rises will invariably switch to steel (steel, so, why Arthur Jemison claimed Dan Gilbert could readily be exempted from the 20% affordable guidelines for his Hudson’s Site redevelopment project and so it was totally cool for him to charge $3 a square foot for residential). By the time you’ve made that leap, there is some added cost, so, you know, the sky is the limit.

Taller only begins to generate problems at very large heights, when 1) structural sway begins to require large and expensive mass dampers, 2) elevators begin to take up more and more space and become more expensive, and 3) the large massing of the structure begins to create daylighting and viewshed problems (see “New York, Back In The Day, And Why Massing Setbacks Were Invented”). Also, even though tall buildings are castigated by many urbanists (Vancouverism, or, say, Torontoism), high-rise construction is clearly viable from a market standpoint.

THE BUILDINGS

Larned East – Some sort of apartment building, employing a playful design aesthetic that combines large sections of glazing with staggered, brightly-colored panels between glazing panels.

Larned West – Another sort of apartment building. This one, per the illustration, has some ugly rainscreen or cladding going on– the high-rise equivalent of a McMansion. (I’m just being pragmatic here– ugly buildings get built!)

Congress St. – This is the smallest of the buildings, so, maybe a mixed-use building or maybe retail space. I wanted something that would fit with the massing of the bank building on the corner while not continuing to crowd what is already a very high-density street. Even though it’s north-facing, fitting with the massing of the bank building would allow for some sort

PARKING

I designed (NB: “SketchUp”) a parking garage and figured that, accounting for stairwells, ramps at either end with entrances on Larned, and– the major coup- building the parking garage partially under Larned and Shelby streets, we should be able to achieve about a 60% spatial efficiency, enough, with three underground stories, to park up to 601 cars.

I’ve considered the cost of building a street on top of the finished product as negligible because the entire thing would have to have a “roof” of structural concrete built on it anyway given these cost estimates.

Current scheme: 15 spaces (street) + 224 spaces (lots) = 239 spaces

Required by zoning, and preserving existing spaces: 993 spaces

Proposed scheme: 13 spaces (Street) + 601 spaces (underground) = 614 spaces

So, while we’re gaining 375 parking spaces, we are also adding 602 apartments. The site also has a large, several-story garage directly to the east (I estimated at maybe 400-450 spaces based on the number of stories and the footprint), and numerous other parking garages within a stone’s throw, serving the Cobo Center and the Joe Louis Arena.

Let’s just imagine that not everyone in that building is going to own a car, but I have to keep These People placated, given the divine mandate of plentiful parking in Southeast Michigan. I would argue that the sportsball fans who want to come downtown and demand plentiful surface parking will probably be outvoted by the folks who will pay for the market rate rentals in these buildings.

PRICE POINTS

The assessment data suggest that the five lots are taxed steeply at a rate of over $200,000 per year, which either works out to a data inaccuracy, a special tax exemption, or a highly profitable parking operator. I’ve landed on the last one: Each parking space would have to make $900.58 per year to break even with the cost of taxes and drainage, so, $3.46 in profit per workday. Assuming the $12-per-day “rate in effect,” that’s totally doable. If they consistently maintain 50% occupancy for exclusively weekdays, that’s three times the tax bill and then some. If visitor parkers paid $12 a day, special events parkers paid as much as a few times that rate, and subscription parkers got a discount, even at a 50% occupancy for 250 days, you’re bringing in some serious cash money.

A 601-space, secure parking garage wouldn’t need to necessarily compete with those price points, whether for tenants or commuters– but it might even be able to. Interest and principal on an underground parking space ($25,000) would cost $224.71 a month at a 7.00% rate at 15 years– $12 per weekday for a month would yield $259.99 a month. It’s still profitable, and now we have a pair of giant buildings atop it.

Sticking with my original pricing methodologies, the three buildings would be estimated to cost the following:

Larned East – $46.047m; 302 residential units and 15,500 square feet of commercial.

Larned West – $42.411m; 278 units, 14,280 square feet of commercial.

Congress St. – $4.384m; 22 residential units, 7,500 square feet of commercial .

Parking garage: $15.025m; 601 spaces.

Assuming the new (=landvalue) tax assessment comes in exactly at project cost, this would add $2.309m new tax revenue to the city coffers per annum, enough to hire:

-62 new cops

-41 new schoolteachers, or

-17 “Innovation Specialists,” highly-trained technocrats with masters degrees from the University of Michigan.

If we assume that the old parking operators would want to operate this garage, we’d work with an easy number of $25,000 to add to the cost of each housing unit if that housing unit wanted a parking space. To compare the cost of financing parking as part of housing, my previous figure of $224.71 per month for a parking space would actually be reduced to $119.35 a month at 4% interest on a 30-year mortgage.

CONCLUSION

Operations of paid lots might actually be really profitable. But what’s far more profitable is developing those parking lots into potentially very profitable parking garages underground and building tall buildings over them. Or, you know, skip the parking and just keep the tall buildings.

Stay tuned for more!