Regressive Politics Seem Bad For Economic Growth. Can We Prove It?

The Supreme Court’s recent announcement that it will hear a case about draconian abortion restrictions in Mississippi led me to wonder Just What These Lawmakers In Red States Are Indeed Thinking. Just as I wrote that, I saw a headline about an even stricter bill in Texas that was just signed into law. While red state lawmakers dig in their heels about, they say, “family values,” corporations representing an increasingly diverse base of stakeholders, whether activist investors, gay employees of color, or what have you, are pushing back. We’ve seen a lot more corporate activism in recent years– and I’m not talking about LinkedIn changing its logo to a Kente cloth scheme. It’s actually gotten to the point that Republicans have started lamenting “woke capitalism.” Point is, there’s a lot of tension! But it’s not unreasonable to think that maybe regressive politics actually influence the allocation of corporate power. Does this hypothesis hold?

I looked at the concentration of Fortune 500 companies in all 50 states, starting with Mississippi. In spite of its three million residents, has not a sole Fortune 500 company based within its nearly 47,000 square miles. It’s also the poorest state in the union (more on this later). Could I index the concentration of large corporations against each of the states’ political flavors? Some basic stats are easy enough. Causality, of course, is a tougher nut to crack.

Why The Fortune 500?

The Fortune 500 are a good cross-section of economic activity, because they include both giant companies and smaller companies. The combined list represents about two thirds of US GDP. It’s not in any way a perfect measurement of economic success or health. It is, however, better than simply looking at a list of giant stock corporations by market capitalization (shares outstanding times share price) because that indicates economic sentiment and hype rather than economic product. Amazon, Apple, Microsoft, Tesla, Facebook, and Google (AAMTGFG? what are we even calling The Big’Uns these days since it’s not FAANG anymore?), collectively account today for something like nine trillion dollars in capitalization.

But only two of those companies crack the top ten in the Fortune 500, which measures value by revenue, not by stock performance. Getting into the “well, why the hell do we rely so much on the stock market, then?” is probably a whole book worth of answers. So, let’s just say that the Fortune 500 are a good starting point.

With those caveats, to quote Kai Ryssdal, we’ll have more details– when we do the numbers.

Starting Points

First, I indexed all of the recent census numbers against the number of Fortune 500 companies in each state. Controlling for population is stats 101, people! This also helps us avoid the pitfall of a map where Illinois, Texas, New York, and California are dark blue while the rest of the country is lighter, or whatever. This is one of the reasons why a lot of map infographics really suck. Basic stats failures are also why people say stuff like, “cOrOnAvIrUs hAs a 99.7% sUrViVaL rAtE!” Without, of course, noting that this is dividing deaths into total population, not deaths into total cases.

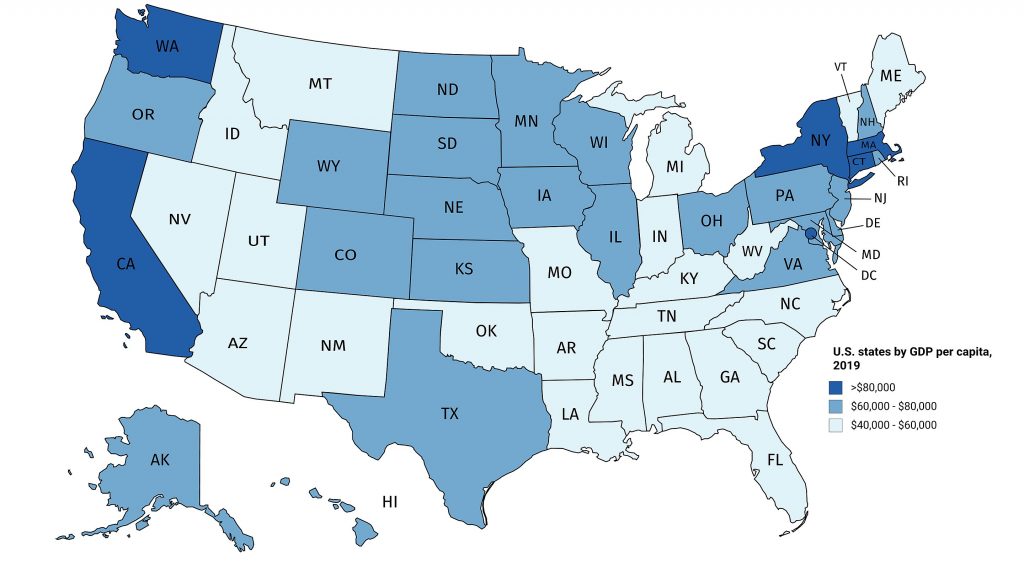

But I digress. This was one of the problems with looking at measurements like GDP growth by state, given that you have some states whose GDP might be skewed massively by a spike or collapse in the prices of some mineral or other resource, even if this doesn’t translate to any gain in income for residents. There’s also a skew in terms of percentage numbers versus numbers controlling for some other factor (like population), given that

What Is A State?

A state is a pretty arbitrary concept from an academic, geometric, or bioregional standpoint, of course, especially when you get to the bizarre rectangles out West. But it’s a useful unit through which we can measure economic progress, especially since in the United States, while power may hypothetically emanate from the people, Republicans (and some on the left, too) will remind you that we are not actually a democracy, so, really, the power actually emanates from the State. I’m being a bit tongue-in-cheek here, of course (me?!). States have an enormous ability to enforce economic regulations and incentives, and, just as importantly but less tangibly, the cultural and political tone of a state’s economy. So, they’re worth considering in spite of the myriad of factors that just might confound some of these conclusions about corporate concentration.

Also, states collect data for themselves, which is why we analyze at the state level versus at the metropolitan level. It’s really hard to analyze cities whose metro areas cross state boundaries, as many do. St. Louis versus Metro East, Cincinnati vs. Kentucky, Philly vs. New Jersey, and so on.

Surprising Winners

There are some surprising things and some not surprising things. First, Rhode Island leads the country with 4.556 F500’s per million residents. Connecticut comes in with a respectable 3.605. The District of Columbia trails slightly at 2.90, with Illinois, the Mecca of Democratic Power, High Taxation, And Corruption, at 2.888 hot, on its tail. (I’m including DC because it is functionally a state in most ways, even if it gets Taxationed Without Representation). Minnesota holds its own at 2.80. High-tax, high-cost New York, home of the financial capital of the Alpha Quadrant and the $975,000 apartment that doesn’t even have in-unit washer and dryer, even rocks a 2.67. Massachusetts’ 2.42 is respectable, and Delaware’s 2.02 is not bad for a state that no one has ever actually been to.

If you’ve noticed that California is missing from this list, you’re not alone! It barely cracks the top 25 at a paltry 1.34. Never mind that Google and Apple collectively hold– as of earlier this week- a market capitalization of a little under $3.7 trillion, just a couple bucks short of the GDP of the Federal Republic of Germany. Return to the thing about the Fortune 500, which is concerned with revenues, not market cap. Does this mean that the Golden State isn’t so golden for corporate growth prospects? I’m not wholly qualified to rule on that question one way or t’other. But it certainly suggests some massive market distortions.

Deep red states Nebraska (#7) and Ohio (#9) perform admirably at 2.55 and 2.29, respectively. They’re the only two red states in the top ten.

Perhaps-Not- Surprising Losers

Not surprising by this metric? Rural states with very low populations were not popular locations for Fortune 500 companies. Indeed, there are 14 states with no Fortune 500 headquarters at all, mostly with lower populations, with the exception of South Carolina’s several million people, a full 2% of the US population, missing out on hallowed corporate glory. But we still see the blue-red trend in this issue. Of these states, 5 voted for Biden in the last election, while 9 voted for Trump:

- Red states at a zero-count (5): Alaska, Mississippi, Montana, North Dakota, South Carolina, South Dakota, Utah, West Virginia, and Wyoming.

- Blue states with a zero-count (9): Hawaii, Maine, New Hampshire, New Mexico, and Vermont.

Into The Weeds (Or Grazing Lands)

Some ideas for why these states might lack corporate interest beyond just a preponderance of low, mostly-rural populations:

- Vermont, New Hampshire, and Maine are far enough away from major urban centers as to not attract much in the way of spillover from nearby areas, as might happen with a company relocating from New York City to Philadelphia or Boston. Infrastructure is limited, and at least Maine and Vermont are both poor states that are heavily dependent upon federal aid. Maine is heavily dependent upon primary industries like logging and fishing, which don’t typically involve locally-based megacorporations. My hometown of Lancaster, Pennsylvania, for example, is close enough to Philly, New York, DC, and Baltimore by car or train that it receives a lot of spillover, even if it’s separated by a whole state from New York.

- Utah, New Mexico, and Wyoming. Each of these states depend heavily on tourism revenue and resource extraction. WIth a few exceptions, energy companies are typically located close to major markets, not close to their points of resource extraction. This is why you have companies like Peabody, Arch, and Patriot based in a city like St. Louis, even though St. Louis itself does not mine coal. The geographic question is also interesting when you think about a place like Omaha, which is home to the headquarters and rough geographic centroid of a major railroad whose major switching hub is a couple of hours west. Chicago’s railroad hub is also a major reason for why that city has historically been home to a lot of big companies, including Armour (of hot dog fame), one of the top ten in the O.G. Fortune 500.

- Hawaii and Alaska. These cancel each other out as far as red vs. blue, certainly, and both states embody singular characteristics that make comparisons tough. Hawaii’s economy relies heavily on the tourism industry, for example, and is separated by a giant ocean from the continental United States. Alaska’s economy is overwhelmingly dependent upon oil, but oil extracted by companies that don’t necessarily have reason to be based there. It’s also separated by, well, a whole ‘nother country, from The Rest Of The United States. In short, both states are way far away from Markets. Both of these states are also heavily dependent upon federal fiscal support.

Political correlations

Thinking about the corporate efforts to quash anti-trans legislation in North Carolina a couple of years ago, I was wondering about whether companies would push back against things like draconian abortion restrictions, voting restrictions, or anti-trans legislation. Netflix spends a ton of money in Georgia, for example, passing off locations in relatively banal topography and deciduous forests as, well, virtually anywhere else in the world. Wandavision = Stranger Things = Walking Dead? Turns out, we can pass off these rolling, wooded hills as literally anywhere in the continental United States!

Pundits on the left have done a good deal of handwringing, while These Trump Types™ have cheered, variously, over the fact that electoral math from the latest census is actually shifting electoral votes to states like Texas and Florida. The truth is actually a bit more complicated than just Red Growth Means Red Seats, as it’s probable that these two high-growth states will become more purple as urban populations grow. As the US becomes less white, it generally becomes less red, given that people of color don’t typically vote for a party comprising virtually all rich, white men (only 17% nonwhite members of Congress are Republicans). This is true in states of either color, red or blue. A blue Texas is, one guesses, at least a remote possibility in 2024, owing to the explosive growth of cities like Houston.

Anti-Trans, Anti-Voting Legislation

This is a major driver behind voting restrictions that have been floated or have advanced in some way in dozens of states as Republicans flounder amid scandal after scandal (the Capitol Insurrection of January 2021, the Trump-effected fiscal collapse, a scandal-plagued administration facing numerous criminal investigations, and a party increasingly cuddly with literal fascists).

So, in Mississippi, the new abortion restriction doesn’t affect Fortune 500 companies based there because, well, there aren’t any. Voting restriction bills are all over the damn place these days, and have even been signed into law in just-barely-blue Georgia, which impressively elected two Democrats to the US Senate last year and whose electors voted for Democrat Joe Biden. Georgia may not retain its hue come 2022, let alone 2024, with the new voting restrictions. It seems doubtful that large corporations will weigh in on these issues, although some Republicans have gone so far as to suggest a boycott of companies like Delta, Coca-Cola, and even the great American sport of baseball, owing to these institutions’ support of things like *checks notes* the constitutionally-enshrined right to vote. Fairly clear that some of these folks would rather us return to the 3/5 compromise.

Similar bills have been signed into law in Utah (tied for last place), Iowa (30th), and Arkansas (16th). And anti-trans bills—like the aforementioned “bathroom bills”- have been signed into law in Tennessee (18th). Side note? It’s always funny to me how Republicans say they’re in favor of smaller government until it involves determining what genitals you have and with whomst you’re having sexual relations.

The Vaunted Paradigm of “Red State Freedom-Loving Growth”

Ted Cruz praised Texas’ electoral growth as a message that people prefer “freedom” to high-tax blue states up north. Damn Yankees? To this end, Republican policy talking points perennially emphasize the value of reducing the size of government and promoting a business-friendly regulatory environment. Let the free market decide, they say! Never mind that when corporations flex their muscles, the literal definition of the free market deciding, conservatives decry this as “cancel culture.”

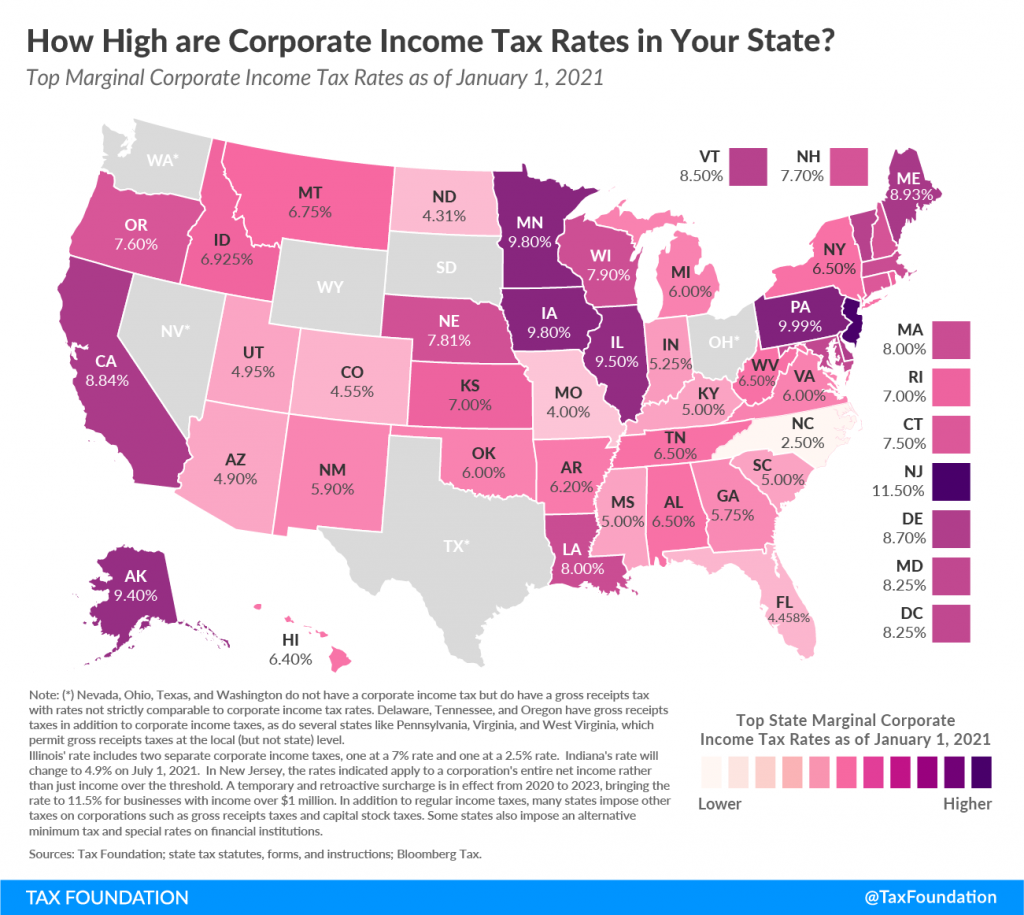

But the data do not show that this whole “people love freedom” thing is actually playing out too well. This is especially salient given that we’ve got a solid nine mostly-red states tied for 36th place in being the home to zero Fortune 500 companies. Texas even lags at only 13th, behind high-tax New Jersey (12th), Massachusetts (8th), New York (6th), and Illinois (4th). Of course, one could try and poke holes in this argument by pointing out that Fortune 500 growth doesn’t translate to small business growth (very hard to measure) or shareholder value creation (easier to measure but completely dubious– think the trillions in market capitalization concentrated in Silicon Valley).

Simple Hypothesis: Blue = More Corporate Power

The simplistic hypothesis that “blue states have a higher concentration of Fortune 500 companies per million residents” actually holds pretty true. For 33 states, the hypothesis held. This is not just a majority, it’s a plurality. We know from oodles of evidence that higher population density correlates to higher economic productivity to a large degree, and this is similarly supported in the data comparing the F500 ranking to population density rankings.

Considering Complicating Factors

Factor 1. We might try and account for some of our outliers by way of what we call the Modifiable Areal Unit Problem. This is a sort of academic paradox that says that the conclusions we draw from data based on boundaries can be rather arbitrary because sometimes those boundaries are rather arbitrary to begin with. While this isn’t true for state boundaries, it wholly explains things like gerrymandering– how the exact same distribution of 50/50 red/blue voters can result in unequivocally red or blue outcomes depending on how the lines are drawn.

The MAUP isn’t really a confounding element when we’re looking at state boundaries because state boundaries are pretty solid lines as far as analysis and geography and can’t really be redrawn. But we often consider the MAUP as problematic in studying density specifically, and thus it’s hard to get much more granular than saying, “more density generally results in more growth per capita.” We have examples of some rural-ass states that rank very highly: Minnesota, which ranks 30th in population density but 5th in corporate concentration. I have spent many moons in Minnesota and I can tell you that there is damn near nothing in the rest of Minnesota outside the Twin Cities. It’s like, a bunch of trees, small engine repair shops, and, you know. Swedish things. Lakes. Whatever. Anyway, guess where all of the state’s Fortune 500 companies are headquartered?

Other Geopolitical/Economic Factors

Nebraska is also an interesting one. It’s ranked 7th in corporate but 43rd in population density. There’s a bit of skew given that any number of corporations being here would increase its numbers because the state’s population is very low. Part of this is that the state is located in the middle of the United States, which is more or less why Union Pacific is based here. Warren Buffett is also based here—Berkshire Hathaway. And, of course, being in the middle of the US, Nebraska also grows a lot of corn and a lot of cows. So, ConAgra.

I might call this an Industry Anticluster. It’s not a cluster because it’s not like Union Pacific chose to be located near Warren Buffett. Rather, it’s that companies like ConAgra and UP probably benefit from being in the middle of, well, it all. (Also, read about how ConAgra demolished all of Omaha’s historic downtown to build a hideous, modernist, corporate campus). Illinois’ numbers are skewed by the relatively high density of Chicagoland (about 65% of the state’s population) versus the rest of the state (about 80% of the land area is not in Chicagoland).

What About The West?

Wait, isn’t this true in most states? Well, not really. Some states don’t actually have dense, urban population centers at all. The Plains and the West are good examples if you look at Montana, the Dakotas, Wyoming, Idaho, etc. Utah might be included here but The Funny Underwear State has seen massive urbanization in the Wasatch Range Corridor in the past twenty years, so this may all change.

So, given that most states have some sort of push-pull between cities and rural areas, this isn’t perhaps all that notable. But the MAUP is why we’re also using states as independent units, not just population density numbers. State borders have historical justifications, of course, but, while they are largely useful in providing disproportionate power to hogs and hunting rifles, they do indicate the geographic limits of aggregated State power that can attract or drive away potential economic investment.

Takeaway No. 1: Deregulation is a dish that must be served with great care.

We don’t have much evidence that Republicans running the show actually ends up with the government getting out of the way to let the free market do its thing. There’s already plenty of evidence that Republicans generally do little to reduce the size of government. They definitely tend to increase budget deficits, something Mr. Trump did expertly well before the COVID pandemic hit. Deregulation, if it actually makes it easier for businesses to grow, is a great thing. Deregulation if it just involves slashing rules and policies that were created for a good reason is, well, stupid.

Nor do we have evidence that Republican policies explicitly end up promoting economic growth, which is perhaps a separate issue. We saw anemic macroeconomic growth numbers under the Trump regime. But we also saw extremely costly regulatory warfare that wasn’t good for business and wasn’t good for consumers.

Takeaway No. 2: Policymakers need to understand externalities.

Something I’m always thinking about is whether there isn’t a huge degree to which deregulation actually causes way more problems than it solves—think the horrific air quality in my own Southwest Detroit, or the petrochemical toxicity in the River Parishes of Louisiana. Perhaps a great example of capital-E Externality is the juxtaposition of Republican climate change denialism and the hundreds of billions of dollars in economic damages that have affected almost entirely deep red areas of the Gulf Coast in recent decades. Like. I’m just saying? Maybe we should think about this? Companies might continue to locate in disaster-prone areas. But they’re not going to locate in disaster-prone areas where state governments don’t have their shit together in a major way.

This will become an ever larger issue as climate change transforms capital markets. Bankers are woke? No, just companies responding to market forces. Honestly. Bankers are probably the least woke people on the planet. But they tend to realize which way the wind blows, even if it’s at a languid, moribund pace.

Key Takeaway: Invest In Progress, Not In Subsidy. Look Forward.

But we have a bunch of evidence here that the deepest red states actually, uh, kind of suck at attracting corporate growth or power. Corporations spend a lot of money lobbying Republican legislators, of course. But this seems to be more to gain influence on specific issues at a federal level. There isn’t a well-developed apparatus to connect lobbying money or interest to economic development except– and this is a huge “but”- to try and attract corporate investment with lavish public subsidies. It kind of works, if you’re cool as a policymaker with borrowing against the future, but it’s also largely a zero-sum game and probably something we’re going to at some point have to tackle with some sort of well-crafted Constitutional amendment to prevent states from just feeding off each other.

The major takeaway for me, though? Turns out that when your state doesn’t invest in infrastructure, doesn’t invest in education, and doesn’t promote sustainable urban growth, that’s actually correlated—if not by way of totally overt causality- to limited interest from the Fortune 500 in getting down in your state. Who’da thunk? Mississippi could do well spending more money on these things instead of spending a limited amount of legislative time on attempting to re-litigate Roe v. Wade, chasing down women, men, and enbies in locker rooms and bathrooms, and so on. Neighboring Alabama similarly spends quite a bit of money on frivolous road widening projects or even monumental freeway projects. Oh, and, you know. Voter restrictions. Anti-trans legislation.

A Plea To These Red State Governors

Governors, look at the damn numbers. No one wants to come to your states as it is. Maybe adopt more progressive policy frameworks. Say “yes” to things instead of “no.” Appeal to the masses.

Up north, Michigan benefits from a well-developed industrial base. But with a Republican-dominated legislature and a governor who is enamored of the auto industry and has failed to move the needle terribly far on infrastructure, we aren’t really that far behind in our shortsightedness. (This is further evidenced every time seditionist/insurrectionist/shock-jockess Meshawn Maddock opens her mouth).

The census and economic growth numbers speak for themselves. Michigan’s lagging more progressive states. States like Mississippi and Alabama will continue to lag behind if they dedicate their legislative agendas to saying “no” rather than saying “yes.” States like Texas, which are already not very high on our ranking, run the risk of driving away socially liberal (even if, you know, socially liberal but fiscally racist) companies that are frustrated with California politics– but might well move to a place like Michigan or Minnesota instead. The anti-trans and anti-voting bills are really just a manifestation of a broader problem, and that’s a refusal to acknowledge the fact that the country is changing. A failure to adapt will continue the legacy of these states in lagging behind in economic numbers.