Detroit Park City, No. 1: Mexican Village (1/52)

In my last post I introduced Detroit Park City, a planning research project focusing on the positive potential of converting parking lots to buildings. I’m hoping you have by the time of this post drunk the Kool-Aid and agree that excessive parking isn’t a good thing. If you haven’t, the post and the project summary page refer to some good reads on the subject.

This inaugural entry focuses on the parking lots that I used to walk by every morning on my way to work, namely those that flank the maybe-beloved Mexican Village restaurant, in that neighborhood sometimes called Mexicantown, sometimes called Corktown, and sometimes called, maybe, Corktown Shores. To those familiar with the area, it is bounded by that up-and-comingest neighborhood of Corktown and it is where one goes to get what could loosely be called Tex Mex.

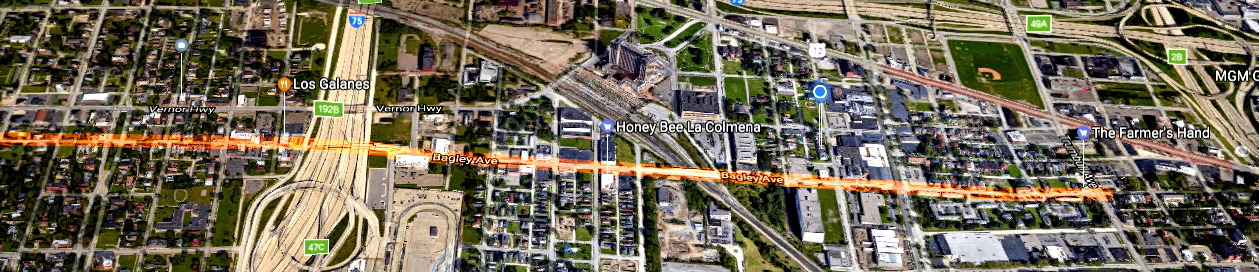

To the unfamiliar non-Detroiter, it is, like much of the rest of the city, a low-density residential neighborhood sandwiched between a high-traffic freeway to the west, a low-density, residential and industrial area to the north, and the same to the east, crisscrossed by train tracks including the freight rail tunnel to Windsor, Matty Moroun’s Michigan Central Station, and Matty Moroun’s Ambassador Bridge. As major rites of passage for a Detroit visit necessarily demand a selfie in front of Moroun’s Folly, or an international visit may demand a trip across the Ambassador Bridge, the geography of the neighborhood is significant for existing traffic and potential new development. (It’s also very close to downtown, about 1.75mi, as the crow flies, from Campus Martius, the Red Square of the People’s Republic of Gilbertistan).

As the neighborhood is neither Corktown nor Shores, so, too, is Mexican Village neither Mexican nor a Village, really. It’s not Mexican because the staff glowers at you if you ask for the cebolla y cilantro with your tacos, and you can’t even get al pastor, but rather, and exclusively, any medley of shredded chicken, ground beef, refried beans, yellow cheese, brown, tan, brown, yellow, and, if you want something non-animal and non-grain, maybe some shredded iceberg lettuce. But I digress, as this is not the Foodbuilt City (one day).

It’s not a Village because it’s a restaurant surrounded by parking lots, more akin, therefore, to an Applebee’s than to anything resembling something “urban.” Some people refer to this area as “Mexicantown,” though “Mexicantown” would appear to be a largely fluid term.

Getting past MCM’s neighborhood boundaries, which puzzlingly split this neighborhood into “West Side Industrial” and “Corktown Shores,” we can see that about a full 2/3 of the space in the neighbourhood is vacant, and, of the occupied sites, there is a lot of parking. Truck parking, car parking, parking for warehouses, parking for enchiladagoers who drove all the way from Downriver. Toward the river and along the rail corridor, about a hundred acres of land are owned by CSX, Norfolk Southern, Canadian Pacific, and friends.

THE SITE

Prices in what JC Reindl has inelegantly termed the” fast-revitalizing” Corktown have gone through the roof in recent years, so it seems kind of significant to build stuff that can decrease the pressure on stable renters and potentially even provide (gasp) affordable units based on the city’s affordable housing strategy, incomplete but under ongoing development. Far from $600k but far higher than the average $40k Detroit home price, I did a house in this neighborhood that sold for $115,000, down the street from one that sold for $165,000 (cash), respectively about three and four times the average market price for the city. The Grinnell Lofts on Brooklyn Street are offering one unit for sale for $338 a foot while the larger two-family buildings are selling in the low $100’s, which is still expensive when it brings the prices above the $300,000 mark, seven or more times the city average home price. This kind of extreme disparity in valuation really highlights a citywide problem.

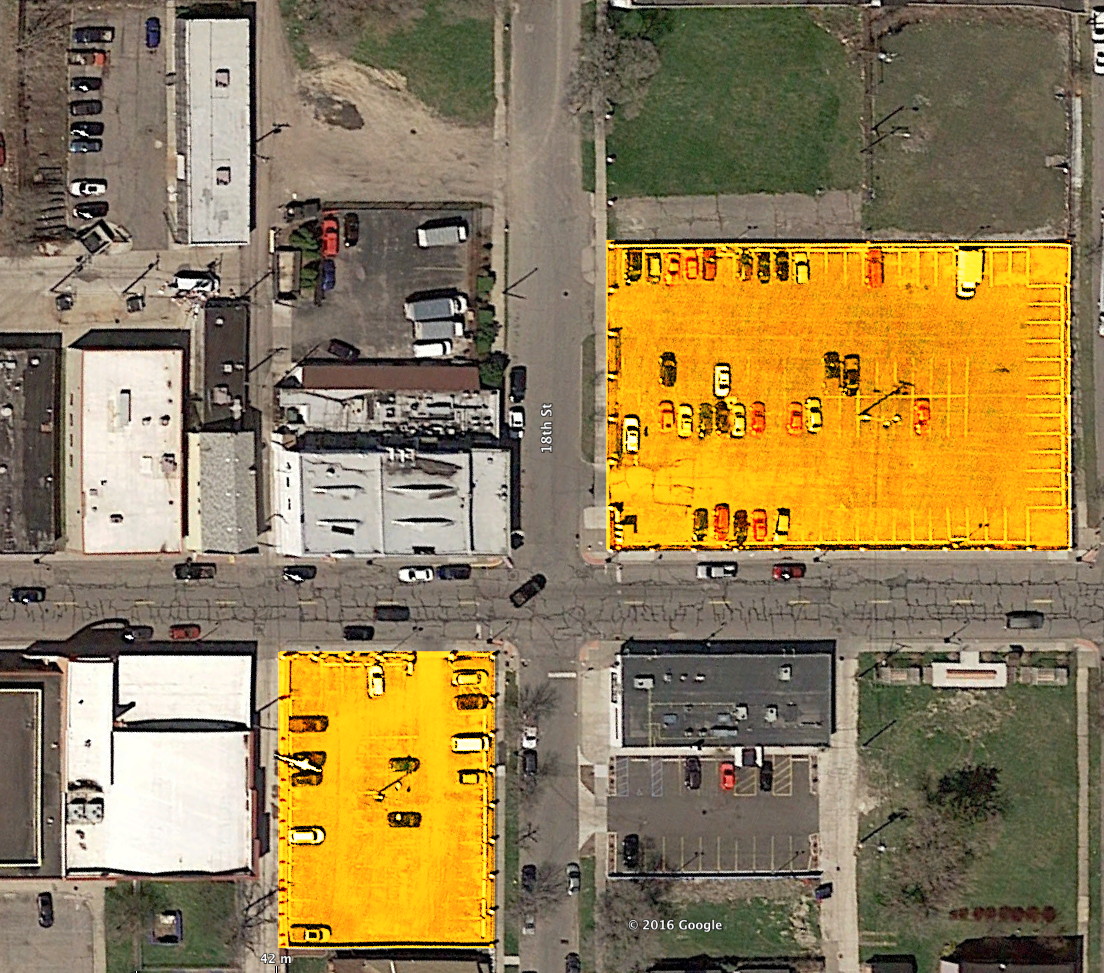

Parking Lot East measures 225 feet (m) by 150 feet (m). Parking Lot South measures 100 feet (m) of frontage on Bagley St. by 140 feet (m) along 18th St. and the alley. So, the two lots work out to 47,750 square feet, six times the size of the footprint of the building itself, which also has a parking lot in back that, as far as I could tell, was part of the same parcel. That’s an additional 8,000 square feet, so let’s call it an even 50 on the three lots. The East lot has about 94 spaces, the south lot about 52, and the lot behind the building about 14.

LESSON ONE: Non-Revenue Generating Parking Is Difficult To Assess As An Asset

It is difficult to quantify monetary value (“convenience value”) of what is currently free parking, except in terms of the tradeoff of what the space could be used for instead of parking. There is no telling how much business Mexican Village would lose if it eliminated all of its non-street parking– very little, I suspect, because the Joint Is Jumpin’- but, the idea of eliminating all of the parking is both potentially feasible (owing to the surfeit of free street parking between the Bagley railroad bridge to the East and I-75 to the West) and certain to elicit the ire of residents who live nearby.

Alan Durning has cleverly likened parking to Netflix— a weird sort of long tail model where the variety and multiplicity are the selling points that individually generate no appreciable revenue and where it is therefore difficult to differentiate pricing from one product to another. There isn’t a great conclusion from this likeness, since, as I’ll indicate in future posts, there is a huge disparity of pricing– why some downtowns offer free or super cheap parking and have none of it is not surprising (inner ring suburb Ferndale has this problem).

The pastoral becomes even more interesting when we realize that there are even adjacent lots, some paved and some not, that are also owned by Mexican Village. How much is that worth? Would customers in the market for a $12 meal balk at 25 cent-an-hour pricing for parking? Would they balk at parking that wasn’t available, in excess, for free? If you’re going to spend $12 for an hour of food and socializing, is a 2% increase to pay for parking too much on top of that?

THE PROJECT

Bagley is an important thoroughfare for foot, bike, and car traffic, since it is the straightest route between Trumbull Avenue to the East and the Ambassador Bridge Import-Export-Customs Unicomplex on the west (Vernor Highway curves and has a messy intersection at Michigan near the train station).

Puzzlingly, the assessed values are extremely low for these sites.

The measurements are tricky to understand even for urban planners and especially for mere mortals: State Equalized Value, or SEV, is defined as the building assessed value (also known as the “improvements” or “improved value”) plus the land assessed value, while the total market land value, a separate variable, is generally 2x the land assessed value, as a colleague from the City of Detroit explained. The average of the land value and SEV suggest that the sum total of this site is worth $100,000, including the restaurant, so, $1.30 a square foot. Subtract the restaurant and you’re well under a dollar a foot. The degree of variance is also high, with the land value sometimes as low as 17% of SEV, and sometimes as high as 227% of SEV. At an estimated $7,179 in annual taxes for the lots, that’s not much money in an area where homes sell for $150,000 cash.

The conclusion is that an outrageously low assessed value will of course serve as a disincentive to development, and parking shall remain parking forever and ever amen. I say “outrageous” because new area rentals are filling up at well over a dollar a foot, and this would mean that development could easily be done more profitably than allowing parking to remain parking. I have estimated the monthly stormwater drainage charge at a considerable $1,209.69, considerable in terms of the marginal profit of medicore tacos sold, but ultimately minimal in the context of a $13-15m project.

LESSON TWO: UNREALISTICALLY LOW TAX RATES ARE A DISINCENTIVE TO DEVELOPMENT

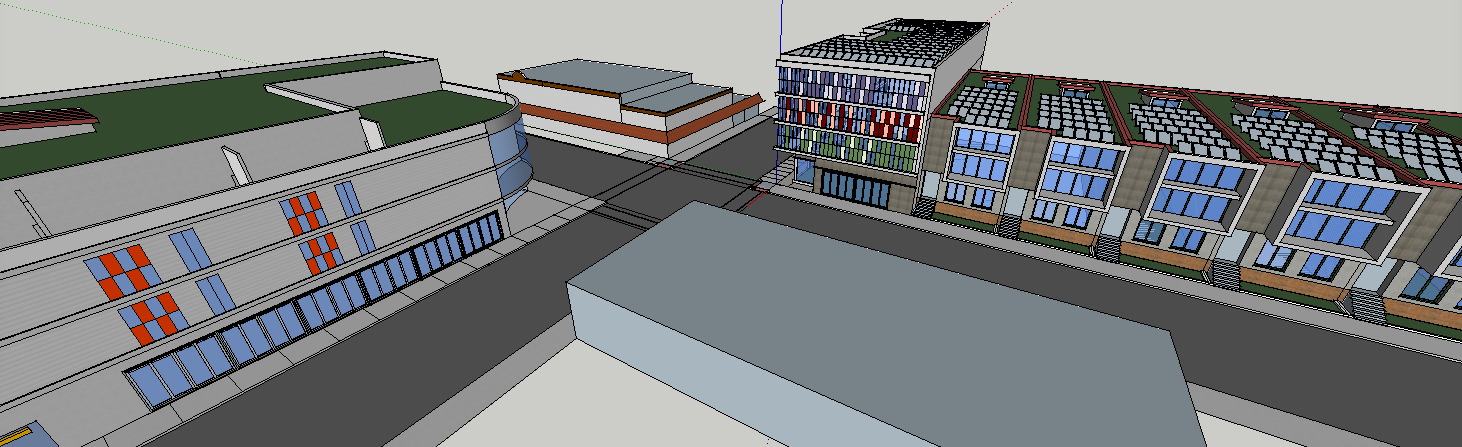

My proposal includes three distinct structures, or sets of structures, including seven multi-unit townhouse buildings fronting on Bagley, a corner building with first floor retail (and/or room for offices), and a corner building on the southwest lot.

The corner building has a footprint of about 6,700 s.f. and four floors for a gross floor area of 21,440 s.f., the townhouses are a total of 35,700 s.f., and the southwest lot building is 33,600 s.f. including first floor retail and underground parking. Density works out to something in the realm of 50-80 dwelling units per acre (a range because I ignored the balance of the vacant space to the north of the parking lot site, which overlays a total of about a dozen lots).

Development financing could either rely on the use of tax credits to create and maintain affordability based on AMI-specified ranges (Detroit Metro’s 80% AMI is, say, double the cost of what it would have to be to serve the city), or, barring tax credits, could rely on a model subsidizing lower-cost affordable rentals with higher-cost ones. The napkin math here is sensible: If one needs $1 per square foot for residential rentals, a high-end rental of $2.25 could subsidize rental rates under $1. Same is true with retail and maintaining affordability as opposed to ensuring that the space isn’t dominated by craft cocktail bars that are unaffordable to the neighborhood. It’s conceivable that the first-floor retail spaces, comprising $3.63m of the total budget, could be finished out more cheaply if the tenants were to finish the spaces themselves.

PARKING

Here’s where it gets a little more tricky. The City of Detroit would require 98 spaces for this new development plus additional for retail, and, if the restaurant needs all 156 spaces, we would come up with the need for 254 spaces. But there are already up to 60 spaces on the street, the townhouses can readily fit 40 surface spaces behind them, and I would submit that the 156 spaces that the Village has, it doesn’t need.

Current scheme: 60 spaces (Street) + 156 spaces (Lot) = 216 spaces

Proposed scheme: 60 spaces (Street) + 44 spaces (Off-street surface) = 104 spaces

Proposed with added parking: 60 street + 44 off-surface + 84 underground = 188 spaces

$144,000 per residential unit constructed fits into a reasonable price point for sale (or rental), and the project would cost an estimated $15.08 million. As I also wanted to understand the idea– and efficiency frontier- of the point at which density allows underground parking to profitably be factored in, I considered that, too.

Adding 84 underground spaces at an estimated $2.1 million would bring our total to 188 spaces, but where it becomes untenable is if the restaurant is asked to now pay for those spaces– no revenue model in a world of Forever Free Parking makes that work if they are only currently paying $93 per year per parking space in drainage costs and $46 per year per space in taxes. Amortize that over a 15-year financing term, you can afford to build two new apartment units plus interest based on this same costing model, or 10-13 underground parking spaces.

Still, if we add the underground spaces, we have only effectively decreased the number of spaces available from 216 in the original model to 188. As the street spaces are rarely occupied, it stands to reason that this may be entirely suitable for the project requirements, eliciting only minimal kicking and screaming.

Some cursory numbers, in conclusion:

| Current site | Proposed development project | |||||||

| Current spaces (observed) | Efficiency (Spaces / Area) | Spaces required by code | New spaces proposed | Spaces present (incl. street) | New units proposed | Construction costs (excl. parking) | Construction costs (+ extra parking) | Estimated new tax base |

| 156.00 | 39.00% | 98.00 | 128.00 | 188.00 | 78.00 | $14,972,100 | $17,179,020 | $ 1,513,385 |

I will likely come back to this as I’ve refined what has become a giant and complicated spreadsheet to look at all of these numbers in aggregate, but in the mean time, onward!