Study: Detroit CBO Is Not Quite There Yet

A new paper by Lisa Berglund and Sam Butler gauges the success of Detroit’s Community Benefits Ordinance. The CBO seeks to establish Community Benefits Agreements, or CBA’s, from developers of projects above a certain threshold in size. Congresswoman Rashida Tlaib pushed for Detroit’s CBO prior to her election to Congress when she was with Sugar Law Center in Detroit, beginning in 2014. The Duggan Administration pushed for a scaled-down version of this original proposal. Guess who won? Well, the answer might not be surprising. But there were some interesting takeaways from the article, which drew conclusions from interviews and responses from members of the Neighborhood Advisory Councils (NAC’s) attached to each CBA.

What Is A Community Benefits Agreement?

CBA’s are defined as “arrangements where community support for a project is exchanged for developers taking on the costs of providing

benefits to a community” (Berglund & Butler’s own words). Development projects create benefits that are hard to quantify, like improvements in the macroeconomy through job creation, and so the goal is to create easily quantifiable outcomes through a CBA. Job creation numbers specifically are pretty elusive in the context of economic development. Especially larger corporations often wave about lofty numbers of even “jobs preserved” rather than just “jobs created,” as though to suggest that the city fathers should be grateful for General Motors’ continued investment in this place, or what have you.

The goal to provide easily quantifiable, tangible benefits improves the legibility of the community development process. The idea is that it will also create trust and facilitate more development, in turn. CBA’s can provide for local hiring requirements, investments in public works, or mitigation of environmental impacts. The benefits, which the NAC’s in part identify, are often quite concrete, practical, or even quotidian– building a basketball court or improving a park, for example.

Democratic Socialism vs. Detroit Neoliberalism

A bit of history. Rashida Tlaib, a fierce fighter for her native Southwest Detroit well before she arrived in DC as a member of the “Squad” of Democratic socialist women alongside Alexandria Ocasio-Cortez, Ilhan Omar, and Ayanna Pressley, had advocated for what would come to be known as Proposal A. Under this proposal, a CBA would be required for any project over $15 million in value, and/or those receiving more than $300,000 in public money. The CBA would constitute a legally binding agreement. This would cover a number of projects in the city.

Tlaib and others pushed for this amid Detroit’s heavily problematic “comeback” narrative that was punctuated with massive wealth inequality, the glitzy glamour alongside the depravity of disinvestment. Shinola watches, made by a billionaire-owned company, assembled steps from unthinkable poverty? That kind of thing.

The vultures circling on the carcass of Detroit’s real estate market in the aftermath of the subprime mortgage implosion comprised principally a few billionaires, each of whom had their own specific projects that would prompt more and harder conversations about this. Dan Gilbert (Quicken Loans) developed residential, mixed-use, and commercial real estate in the downtown core specifically. The Ilitch Family developed in Midtown and the Cass Corridor, principally around the Little Caesars Arena. And the Moroun Family develops speculatively around lots targeted for redevelopment (the FCA Jefferson East land swap) or the Ambassador Bridge in Southwest Detroit.

Corporate Capitalism Tempering Pluralistic Dreams

The Duggan Administration floated an alternative, Proposal B, which drastically scaled down the original format. Embracing the same “business-friendly regulatory environment” that results in my front porch being covered in soot every morning and the air always smelling faintly like garbage, Duggan allies made an aggressive and successful push to increase the threshold from $15 million to $75 million in project size, and to increase the $300,000 public financing term to $1 million. This drastically reduced the number of projects that would necessitate a CBA. Berglund and Butler write:

The City’s approach of introducing a more developer-friendly CBO that competed with and ultimately defeated the grassroots, community-centric proposal has in some ways painted the public’s image of the city’s role in distributing the benefits of development.

No one should be surprised that Duggan is on the side of business. The question is rather whether it is ever enough to be on the side of business. For the literally billions of dollars that Detroit taxpayers have spent on Sugar Danny, the man’s health incident seems to have effected a drastic reorganization– and downsizing– of his empire, most iconically affecting the Hudson’s site. It’s unclear to me– as a city planner, MBA, and someone who spent years in real estate development- how it is possible to get an agreement for hundreds of millions of dollars in taxpayer subsidy, and then simply shrug and say, “oh, yeah, this is actually going to be smaller now. Whoops!” The city and region are meanwhile still struggling to retain talent and population. Water is wet.

Muddled Program Objectives

That’s perhaps a story for another day. The point is, there are an awful lot of eggs being put into the basket of this big business affinity, and the results are dubious. Such is also the case with the Neighborhood Advisory Councils and the Detroit CBO. Berglund and Butler identify a “feeling that the benefits won were not commensurate with the public financial investment into the project at hand,” and this problem is compounded by the fact that many stakeholders, even within city government, seem to be clear on what the actual objectives of the CBA’s should be. The authors go on:

when asked what the role of City staff was meant to be, some felt that their role was to provide [the] community with tools to negotiate, while some felt that they should act as a neutral facilitator; others were still on the fence about the role they should play. This confusion does not mean that planners were acting in a neutral manner, as there are aspects of the Ordinance (and the development process) that they are a part of that place residents at a systemic disadvantage. Additionally, implicit bias is difficult to observe based only on participant interviews, and it would be reasonable to expect that City administrative staff who work closely with the Mayor’s office may be biased toward developers, if only from unconscious professional self-interest. This made advocating for inclusion difficult for City staff, and more complex than a one-directional exertion of power on the local community.”

Takeaways

Berglund and Butler importantly identify a number of procedural problems with how the Detroit CBO is administered. This effectively restricts who ends up being able to participate in the NAC’s. A lot of this really comes down to the problem that the restrictive capital climate means it’s really hard to get involved in development as a developer, let alone as a citizen. In other words, restrictive lending and investment from banks and other corporations make development hard to begin with, but it’s even harder for us mere mortals to comprehend how we can participate in community development when we don’t have access to the tools or even the communication channels. I’m looking at three steps here.

Beyond Gestural Community Engagement

First, let me say that I’ve been to a lot of community meetings, both as a resident, planner, and developer. And verily I say unto thee that there are very few instances I can ever think of when the developer has ever intentionally worked with the community to assess needs and wants. Years ago, when discussing community opposition to St. Louis billionaire Paul McKee’s ultimately doomed Northside Regeneration debacle, a colleague said to me, “you know, he probably could have avoided this whole issue by going to each individual resident on that block, writing them each a check for $30,000, and moving on.” Instead? He engaged in a long con of subterfuge, dug himself into a hole, and pissed a ton of people off.

Having public sentiment on your side– by way of keeping people generally amicable- is a huge win. It helps avoid lawsuits and it oils the gears of capital machinery. So, an open letter to developers here: This begins with a simple but meaningful, direct, and intentional conversation. Embrace that conversation. Be intentional. Build relationships that matter. It’s fine to have a business that is making money. But you can’t do development in Detroit if you don’t understand Detroit. And you can’t understand Detroit unless you understand the people.

Meaningful Community Investment Policy

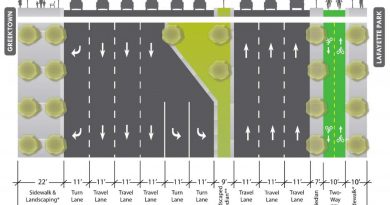

The “business-friendly” regulatory regime in CAYMC is never going to put Detroiters first because the powers that be believe in Reaganomics. That doesn’t mean Detroit should give up on the CBO. It just means we have to push for something better. That doesn’t begin and end with the CBO. Detroit can revise the CBO. But it’s never enough for us to simply say “no.” We must figure out new ways to say “yes.” Detroit could use an aggressive YIMBY platform that makes community benefits a direct focus.

There are some easy targets. Remove parking minimums! Promote TOD! Honestly, most developers would be eager for CBA’s if they could avoid parking minimums. Or get some other kind of density bonus. It’s certainly all possible. But it’s wholly unlikely if people like Mike Duggan or Scott Benson simply paint every issue in terms of “development-friendly” vs. “not.” It’s time for more imaginative discourse on the subject. Berglund and Butler offer us a valuable assessment of the Detroit CBO as a relatively new program– it is hopefully just a stumbling block on the path toward a much more robust, equitable system of development.