Toward An Equitable Stimulus Package

Until March, US President Donald Trump had long obsessed over the stock market’s soaring valuation, touting it in frequent, all-caps tweets. It doesn’t matter so much to him that average Americans do not benefit from gains in the stock market– even if they stand to lose from its collapse. Or that tens of millions of lower-income Americans actually have a negative net worth— largely as a product of the explosion in debt that was fueled by interest rate cuts following the 2008 mortgage bubble collapse. But now that the market has crashed as the country faces a global pandemic that promises to be as bad as the 1918 H1N1 Spanish Flu, talk has turned to that old chestnut of federal stimulus. The current stimulus that was passed after days of bickering in Congress is likely one of what will be a few over the coming months. While it’s unclear that the federal government has any money to spend at all these days after blowing it on corporate tax cuts and handouts to the wealthy, it’s vital that we get this right if it’s going to happen at all.

In this article, I’m outlining principal elements that must be included in an equitable stimulus package. TLDR: 1) Investing in infrastructure for things other than automobiles; 2) Ending mass incarceration and provide job training and education as a means of growing a competitive labor force, especially in technology, construction, and healthcare; 3) Investing in renewable energy and decarbonization of the economy; 4) Creating a universal, single-payer healthcare system, and; 5) Creating a robust plan to address wealth inequality, beginning with a gradual rewriting of the tax code that simplifies the tax code for individuals, and aggressively and progressively increases tax rates on the wealthiest and on corporations.

A BACKGROUND: TOWARD WEALTH INEQUALITY

The President has made it clear that he is not terribly interested in the plight of the everyman– in stocking his cabinet with, among others, purported billionaires like himself, or actual billionaires, no matter how unpopular they may be. While this is would appear diametrically opposed to the stereotype of his base as the disenfranchised working-class, it is firmly in line with the well-documented support he receives from big business and the financial elite— as the United States’ wealth inequality has soared over the past four decades.

Of course, this didn’t begin with Trump. Tax code revisions– specifically rewrites over mostly Republican administrations to give money back to the wealthy under the perverse guise of “equitable” and “fair” treatment- were primarily responsible for exacerbating wealth inequality. Erosion of workers protections certainly didn’t help, either. (Ronald Reagan rocked both of these approaches).

While bailouts do not cause wealth inequality, they have not, for the most part, mitigated it. An opportunity for a bailout is an opportunity to examine why it is needed. In the case of TARP (2008) and whatever we can expect out of Washington in the coming days or weeks, these bailouts were created in no small part as responses to the perilous culmination of unchecked greed.

We can look back at the booming housing market of the mid-2000’s. This was largely fueled by super risky debt instruments. Just as now, immediately preceding the collapse, so-called experts were saying everything was just fine. The portent of the 2009 recession came in the form of the collapse of Bear Stearns in March 2007. A hitherto well-respected firm that went off the deep end of the bizarre leverage products that ultimately broke the economy, Bear’s balance sheet exploded and it ended up writing off billions in debt. Its smoldering remains were sold for pennies on the dollar to JP Morgan Chase. Following this, the Dow rose another 10%. Lehman Brothers would suffer the same fate in 2008. From its October 2007 peak to its February 2009 trough, the stock market lost 50% of its value.

The first [bailout] was geared toward propping up a system that had failed entirely through its own fault. The second one was geared toward stabilizing an economy by investing in its people.

Across the last few recessions, there were two major federal interventions. These can generally be termed “the bailout” and “the stimulus.” I’m excluding the airline bailout of 2001 (the dot coms didn’t get bailed out– their implosions were considered an acceptable assumed risk). I’ll also mention two major legislative reforms under the reigns of Bush the Younger and Barack Obama that are important to understand here.

TARP (2008)

The first was George W. Bush’s “bailout,” the Troubled Asset Relief Program, or TARP. TARP, authorized by the Emergency Economic Stabilization Act of 2008, poured hundreds of billions of dollars in loans and equity investments into banks and the auto industry to shore up liquidity. Much– but not all- of the money was eventually returned. TARP succeeded in stimulating lending and liquidity, though the mortgage market has never quite recovered psychologically from the 2008 crash. Appetite for risk has diminished for senior lenders. Low interest rates create incentives for expensive mezzanine debt and speculative capital instead of bank lending. Critics note that peculiar accounting requirements inappropriately depreciated the amount of money that ended up getting returned to the government. Other critics question its effectiveness at large. Its effectiveness in stabilizing markets is fair praise, but it was expensive at around $500 billion during a time when Americans suffered a cascade of foreclosures and evictions. HUD HHF, part of TARP, was meant to combat this crisis. But a decade later, we see examples of it being used for things that have nothing to do with foreclosures or evictions– like demolitions in Detroit.

ARRA (2009)

The Obama Administration authored the American Recovery and Reinvestment Act, or ARRA– a.k.a. the stimulus package- in the infancy of its tenancy in the White House in February of 2009. Taking office at the beginning of a brutal recession was certainly not an enviable feat, but it made his election that much easier. Experts concluded that the ARRA was also largely a success. It stimulated the economy by promoting massive investment in infrastructure. It also put money directly in the hands of American families– although critics noted that a Byzantine tax code made it hard for many tax filers to understand what credits they even qualified for.

The Obama Administration, for its many faults, had a strong technocratic regime, and was shrewd in its management of strings attached to the bailout packages. Obama’s Fed approved the transformation of GMAC into the benignly-branded Ally Bank after the former got mired in bad debt including debt from predatory loans. CAFE standards required the automakers to transform their product lines to be more fuel-efficient. This was a noble goal on its own as a matter of carbon reduction, but oil was also soaring in 2008.

These are worth mentioning because they were two very different packages of spending that had very different effects and very different purposes. The first one was geared toward propping up liquidity in a system that had failed entirely through its own fault. TARP allowed the financial sector to transfer some of their risk to the public. The ARRA, on the other hand, was geared toward stabilizing an economy by investing in its people.

ADDITIONAL LEGISLATION

Beyond bailouts, it is worth mentioning two pieces of legislation. The Sarbanes-Oxley Act of 2002 was passed in the aftermath of the telecom and energy implosions of Enron, Adelphia, and others following the dot-com bubble. It survived legal challenges and focused on reining in corporate greed at the executive level by requiring enhanced accountability. The Dodd-Frank Consumer Protection Act of 2010 was passed in the aftermath of the subprime mortgage crisis. It was the hallmark reform of the Obama Administration after the Patient Protection and Affordable Care Act (also 2010), and focused on financial regulatory reform. It, too, survived far more aggressive legal challenges including a lawsuit from eleven states (unsurprisingly, all of one of which were deep red).

Donald Trump has since defanged the Dodd-Frank-created Consumer Financial Protection Bureau by appointing to lead it a man who spent years trying to dismantle the agency. As such, consumer protections have steadily eroded. This is in line with Trump’s attempt to essentially dismantle the federal government at large.

Along with the regressive Trump tax cuts and the fawning COVID19 task force’s mantras about the virtues of the private sector, the message is fairly clear: It would seem that Republican leadership would prefer an oligarchy. If this isn’t the case, why so much focus on protecting powerful institutions rather than the people who empower those institutions? In debate over the current stimulus bill, South Carolina Senator Lindsey Graham went so far as to say that, effectively, poor people don’t deserve as much money.

AN AIRLINE BAILOUT?

Flash forward to the modern day. COVID19’s most apparent effect is on travel– and Trump has mentioned bailing out the airlines. Critics point out that this is a little bit ridiculous given those companies’ years of cruising-altitude profitability since their last bailout in 2001. And also, uh, given their utter refusal to invest money wisely to be able to plan for this sort of catastrophe. Other critics note that airlines are big corporations, and a bailout would set a precedent to encourage more bad decisionmaking. (Similar criticisms were leveled at TARP). Indeed, the airline industry spent most of its free cash flow– bolstered by the Trump tax cuts- on stock buybacks. And now it wants money to stay above the ground. Proponents argue that air travel constitutes critical infrastructure, and argue that a “bailout” would most likely be more of a loan that would be paid back with interest.

The size of the bailout aside, though, it’s worth noting from a financial standpoint that, relative to the size of the economy at large, airlines are actually quite small. The entire airline industry is less than 10% the size of the US tourist industry, for example– and you could fit several airline industries inside an Apple Computer market capitalization. The cruise ship industry, which has more or less been completely shut down as a result of COVID, is about a third the size of the airline industry. Bailouts that have occurred in the past– notably the Air Transportation Safety and System Stabilization Act after 9/11- are effectively pocket change in comparison to a program like TARP or ARRA. The role of transporting passengers between cities for both business and pleasure is considered vital.

RECONSIDERING THE SCOPE

So, here are the five key points I think need to be included in any stimulus. It’s too late to amend the current one, but, as I said before, we aren’t out of the woods yet. There will be more.

POINT 1: TOWARD MULTIMODAL MOBILITY

Remember the idea of transit concurrency? The question I floated in my conversation to former Lieutenant Governor Brian Calley– who, I’m quite glad, has maintained a positive public demeanor throughout this COVID19 crisis- was that of whether policymakers might include terms in a highway spending bill that simultaneously required spending on transit.

I propose the same for federal spending. It does not make any sense for the federal government to invest money in propping up one system that is not resilient to cyclical downturns– or, indeed, global catastrophes- if systems like Amtrak and local transit systems struggle. To be clear, local transit systems are struggling consistently without COVID19. Amtrak was already on track– no pun intended- to turn a profit this year. A rare occurrence, to be sure. But why does the federal government require Amtrak to turn a profit when airlines don’t? In the words of one observer, maybe the airlines should have saved more money and spent less on avocado toast.

How does it make any sense to prop up for-profit airlines without supporting public infrastructure that serves everyone? And how does it make any sense to not tie bailout money to strict terms banning stock buybacks forevermore? Trump says he’s amenable to it– yet the terms in the bill are quite iffy.

Our infrastructure is literally falling apart. We need new bridges, roads, sidewalks. We need bike lanes. We need busways. We need high-speed rail. We don’t need a hyperloop– but we could certainly stand to invest in some next-generation technology.

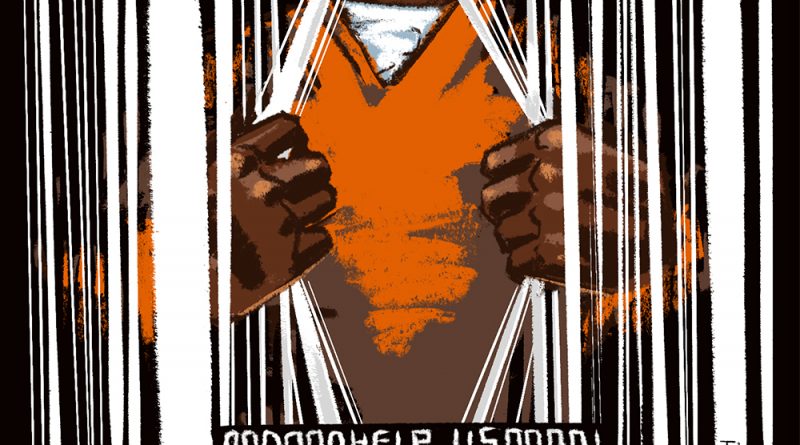

POINT 2: END MASS INCARCERATION.

For me as someone who studies business and spends a lot of time thinking about efficient markets, the prison-industrial complex would seem to be perhaps the most backward way of improving a society. One need not even get into the questions of human rights– which are, be it said, numerous- to note that having millions of Americans locked up is just extremely bad for the labor market.

As COVID19 threatens to become a catastrophic pandemic within prisons, we are afforded the opportunity to take a harder look at why some of these people are locked up in the first place. Hundreds of thousands of prisoners in the US are nonviolent offenders– imprisoned for everything ranging from smoking weed to tax evasion. Especially as states legalize cannabis, it’s unconscionable to leave citizens in prison for possession or trafficking of what is now a cash crop. There’s also the astounding fact that many as a quarter of prisoners at any given time in the United States haven’t even been convicted of a crime.

Addressing this is not just a matter of human rights, it’s a matter of economic productivity. Imagine the ability to add, over several years, anywhere from several hundred thousand to millions of new workers to the labor force. Imagine those workers going into fields currently starved for talent. Construction. Healthcare. Tech. Heck– it’d be cheaper, preferable, and better for the economy to put prisoners to productive use by paying them real wages to do work. While prison labor is fairly limited, prisoners are paid pennies for their work– and gouged on services they need, like telephone calls. Treating human beings like human beings could have positive and transformative effects on the economy and the supply chain.

Some prognosticators are even musing about using robots before they’re thinking about training a bigger human labor force. Ending mass incarceration even has widespread bipartisan support from everyone ranging from the Trump Administration to the [remaining] Koch Brother to liberal activists. It’s just a question of making the moves.

POINT 3: DECARBONIZING THE ECONOMY.

Critics of the Democratic modification to the Republican bill– which was largely modified without Democrats’ input to begin with- argue that it is “not the time” to include provisions, for example, requiring airlines to reduce emissions. But as observers have noted that COVID19 is actually reducing emissions around the globe, and as COVID is a disease that is likely antagonized by bad air quality and the underlying respiratory conditions that it causes, it seems like a small price to pay if we’re already spending trillions on a bailout.

Trump has been all too keen to try and push for bailing out the fossil fuel industry. But critics have pointed out that the entire coal industry employs fewer workers than Arby’s. Solar, on the other hand, is on a growth tear. Low prices of oil, gas, coal have met with limited demand as our society becomes more energy-efficient. Solar power prices have also been dropping consistently for years, strengthening incentives for adoption.

Energy efficiency improvements almost always have a far greater economic benefit than their cost. The less efficient systems are, the more of our money is quite literally going up in smoke. Renewable energy– especially that produced locally on a smaller scale- can make for a more resilient power grid. It also reduces transmission losses, saving money for everyone.

Point #3 can join Point #1 in the conversation about decarbonizing transportation specifically. Transportation accounts for a huge percentage of energy usage in the overall economy. Shifting this paradigm is not just about building electric cars, it’s about changing how we think of the built environment. It is something we talk about increasingly— but still not enough.

No, this doesn’t mean that we have to stop driving our cars tomorrow. This doesn’t mean that we can never eat beef again. It just means that we need to have some serious conversations about why we continue to spend hundreds of billions of taxpayer dollars on a dying energy source.

POINT 4: HEALTHCARE FOR ALL.

Hellbent on undoing the Obama Administration’s entire legacy, the Trump presidency spent a lot of effort on Obamacare– specifically on repealing it. “Repeal and replace!” the mantras said. But Republicans– even while controlling both houses of Congress and the Executive- failed to do this multiple times. Major sticking points included failure to guarantee protections for preëxisting conditions, a cornerstone of the ACA.

The ACA is, in many ways, a dream that should appeal to the neoliberal members of both parties. It forces consumers to purchase a product sold usually by a private provider. This “individual mandate” was among the more controversial points of the law. But, well-deserved critique aside, the ACA also provided important protections for patients as consumers. It has also resulted in far more Americans having far more affordable healthcare.

Trump-era proposals to replace the ACA have faltered. The American Health Care Act of 2017 was passed by the House by 217-213. The Senate took up a series of rewrites– iconically by a group of 13 Senators, all white men– and maintained opacity throughout the process until they were set to vote on it. Attempts to add amendments– combined with vocal opposition from a bipartisan coalition of governors- ultimately killed the bill. Pre-existing conditions were not protected in most of the proposals.

Arguments against socialized medicine claim that it would be “too expensive” and that care would diminish. This isn’t really true, given that private medicine includes not only the costs of care but also the profit margins– as well as the externalized, high costs of poverty, death, and loss of productivity that result from poor care (and, in many cases, are picked up by the government anyway, if not by the nonprofit sector and charities). COVID19 also proves the irony that, as Farhad Manjoo put it, “everyone’s a socialist in a pandemic.”

One of my friends said that the federal response to COVID19 should prove that you don’t want the government managing your healthcare. But that the government has utterly failed to respond appropriately is utterly its own choosing. With COVID specifically, there’s also question about whether mortality rates will be higher in the United States given the fact that Trump’s policy modifications to eviscerate the ACA have left millions of Americans without access to healthcare. Certainly, the egregious wealth disparities in the United States suggest that the poor will suffer far more than the rich.

Across the pond, on the other hand, mortality rates in Germany right now are quite low. While sampling bias may account for some of this, the country routinely ranks highly in terms of its medical care. Similar to Canada, it has a two-tiered system in which you can pay for private insurance, but ultimately, every single person has access to healthcare. For all of our wealth, we don’t have that. And this crisis is showing how bad that is working out for us.

I will be surprised if even for-profit healthcare providers don’t seek a massive bailout themselves. It’s time to shift from a for-profit model. Human life is worth more.

POINT 5: MITIGATING WEALTH INEQUALITY.

This is perhaps the most important one because it drives the other four points. Mass incarceration has proliferated concurrently with the collapse in economic mobility over the past 40 years. Healthcare costs have similarly risen, in line with the rich getting richer and the poor going farther into debt, while wages remain stagnant.

And yet the Republican Party seems obsessed with the idea that trickle-down economics works. Though Reaganomics remains quite popular, both at the national level and even locally in Democrat-controlled cities- we’ve learned that Reaganomics doesn’t actually work.

In idealized market conditions– the capitalist dream- we would have lower tax rates and lower costs of market entry. This could be done by lowering corporate taxes and making it easier to obtain capital or public investment. The problem is that tax code revisions would be required to ensure that corporations actually pay taxes. Many currently do not. Amazon, for example, makes more than a quarter of a trillion dollars in revenue per year, including about 14 billion in operating income. But pays no taxes. There’s something bizarre and broken about this.

Other provisions would need to require that corporations repatriate trillions of dollars of cash held abroad. The Trump tax cuts were supposed to effect this. They did not. The mountains of cash that corporations are sitting on are alone enough to solve the COVID crisis. But corporations aren’t beholden to the demands of the public– they’re beholden to their shareholders.

A comprehensive framework to limit indirect corporate subsidies is also needed. Tax increment financing, tax breaks, and more account for annual transfers of staggering sums of public money to corporations. Most of these result in a net zero gain. Stadiums are a great example.

Mitigating wealth inequality is bizarrely an intersection of capitalist ideology and Marxist critique. Protecting consumers means protecting workers. Empowering workers empowers consumers. Consumers spend money. Money generates economic product. The less capital, dollar-for-dollar, that a consumer has to spend, the less economic product is generated. Marxist critiques of capital accumulation can be used alongside neoclassical models of economic inefficiencies created by massive wealth inequality.

CONCLUSION: THE END OF IRRATIONAL EXUBERANCE

I am going to call a spade a spade: It is time to tamp down expectations of growth in the West. While the irrationally exuberant can count among their ranks as many members as the doomsaying scourges of the financial world, our model is fundamentally broken. It is based on unsustainable cycles of boom and bust– that quite literally kill people while failing to do anything good for the average citizen.

You don’t need to go back to Malthus to think about modern ideas for the limits of growth. Tom Osenton looked at this in 2004– a bizarre bull market between the 2008 crash and the dot-com collapse, 9/11, and the energy/telecom scandals- in his book, The Death of Demand. Osenton isn’t arguing to dismantle capitalism. Rather, he argues that we’re going to have to rethink our models. Growth, he points out, is limited by far slower population growth in the modern West than before. That doesn’t mean we have to abandon capitalism. It just means that we can’t simply sell more widgets to satisfy the next quarterly earnings report.

TOWARD A BETTER WAY TO MEASURE SOCIETY

Similar to Osenton’s book, this piece isn’t a critique of capitalism. It is a critique of the obsession with wealth aggrandizement that does nothing for society at large. Specifically, it is a critique of the obsession with growth and wealth alongside an unconscionable prevalence of destitution and suffering. A society cannot measure its success based on its stock market when it allows its poorest to die in medical poverty. While it incarcerates millions and strips them of basic human rights and dignity. Dostoyevsky said that “The degree of civilization in a society can be judged by entering its prisons.” In the same vein, Nelson Mandela famously said that “[n]o one truly knows a nation until one has been inside its jails. A nation should not be judged by how it treats its highest citizens, but its lowest ones.”

Prolific dudes though they were, Neither Dostoyevsky (1821-1881) nor Mandela (1918-2013) was particularly groundbreaking in this characterization. The sentiment of humane treatment of the downtrodden, the refugee, the impoverished is a hallmark of Abrahamic religion. It is voiced strongly in Matthew 25:40: “And the King shall answer and say unto them, Verily I say unto you, Inasmuch as ye have done it unto one of the least of these my brethren, ye have done it unto me.”

The Quran provides about the same take: “Have you seen the one who denies the Recompense? For that is the one who drives away the orphan, and does not encourage the feeding of the poor.” (107:1-3; Al-Ma’un, The Small Kindnesses). Heck, even Leviticus– which forbids you to eat of the bunny rabbit, which cheweth the cud, though it cloveth not the hoof– says: “And when ye reap the harvest of your land, thou shalt not make clean riddance of the corners of thy field when thou reapest, neither shalt thou gather any gleaning of thy harvest: thou shalt leave them unto the poor, and to the stranger.”

The Fed’s COVID19 Rate Cuts Can’t Stop What’s Coming

The rise in automation has sparked worries over mass layoffs. It has also sparked a far more important conversation about the nature of our economy. Namely, we are afforded the opportunity to consider what we could do with all of the wealth that has been created by the profound technological innovation of the past few centuries.

Moving from a scarcity mindset, in which everyone is competing against everyone else and some die in destitution while others live like kings, we can move toward a post-scarcity mindset, in which we can still have competition, winners, and losers– but temper “loss” with a bare minimum that ensures that every human being has food to eat, a place to sleep, an education, and healthcare. It is not a radical idea. It can be handily achieved if we consider that our society has already created sufficient wealth for it– we just have allowed it to be concentrated highly inefficiently in the hands of so few.

TOWARD A RESOLUTION

As we examine the current stimulus package and the vociferous debate around it, it would appear that Republicans in Congress care more about corporate power– and holding onto power in the Senate, the Executive, and the Judiciary- than they do about the Judeo-Christian heritage they so frequently tout, referring back to some of the historical examples I set forth about treatment of prisoners and the poor.

During the debate over the current bill, Mitch McConnell, who has frequently bragged about refusing to sign bills that have been passed by the Democrat-controlled house, complained of obstruction by Democratic leadership in signing the stimulus package bill. Lindsey Graham complained that the expanded unemployment provisions were too generous. A Kentucky Congressman has meanwhile threatened to hold up the vote, to no apparent, productive end– but it looks like it may well pass.

But it won’t be the last stimulus bill. Nor will it save the sinking ship of what was just a month ago touted as “the best economy we’ve ever had.”

Our healthcare system is overwhelmed. Yesterday, we not only leapfrogged China and Italy as having the highest number of COVID cases in the world– we also posted some of the largest ever unemployment numbers– that are likely to get far worse. Shuttered businesses mean no wages, and no wages mean no consumption. No consumption means no economy.

It is time to demand better. Any hope we have to rebuild must rely on the development of a resilient, green, healthy, and just economy.

If not now, then when?