Donald Trump vs. The Stock Market: Electability and the Coming Crash

ADP payroll numbers for private sector job growth came out this morning, and the news is ostensibly good. For the uninitiated, ADP is a payroll processor, and their periodic reports are considered a good gauge of economic health.

President Trump said as much in a meandering, jingoistic State of the Union last night, which I watched snippets of during an honestly somewhat lackluster Too Many Zooz show at El Club, which was too packed to be able to even stand in the venue. Trump’s speech, written in his signature, 3rd grade reading level style, railed against “government schools” and talked about the threat of “Islamic terrorism.”

Trump’s case is pretty clear: I’m fighting the good fight for you. Reëlect me and I can keep the dollars rolling in. In spite of his perpetual vitriol and pettiness, his poll numbers confirm that people agree.

And honestly? If the market keeps up, he’s getting reëlected. Period. Impeachment schimpeachment. People don’t vote based on ethics or morals (clearly).

But apart from the fact that multiple sectors are currently in a recession, the economy is at a tipping point. Here’s why.

ECONOMIC PEAKCEPTION: PEAKS WITHIN PEAKS

Trump has defined his economic success based on corporate profits and new peaks for the stock market. This has been a defining thing as the NASDAQ, S&P 500, and Dow Jones have all broken dozens of records. An economist advising Trump in early 2017 might have indicated that economic was slowing, and the then-all-time-high stock market might be near a peak. Unless, of course, something were to stimulate the price of securities.

How about a massive tax cut to corporations? Trump promised GDP growth rates hitherto unknown to the people in this area, to quote a Zappa line.

The tax cuts didn’t come through on Trump’s promises. Economic growth has been tepid. Hiring is slowing. For the most part, corporations have not invested in workers or new productive capital (things like trucks or building new factories).

But what tax cuts did do was allow companies to buy back stock. This drives up the share price and makes shareholders happy. Because executives are rewarded largely based on stock performance, they have a vested interest in driving up share price. Many companies also award employees in stock, too, so there are plenty of workers who enjoy this benefit.

In broader terms, this has driven the stock market at large to stratospheric highs. President Obama presided over a long bull market with a number of stock market records, recovering from the economic crash that he inherited from the previous administration. Trump pushed those even higher. Of course, this has little to no value for the worker who doesn’t have stock options, a 401(k), savings, or is increasingly subjected to the whims of the burgeoning 1099 “gig” economy.

The best the average worker can hope for is that economic expansion and stock market highs mean more capital being allocated to things like payable hours or overtime. On the flipside, if the whole house of cards gets knocked down, workers will suffer from job cuts as companies frantically trim expenses. So it goes.

A DEEPER DIVE INTO THE NUMBERS

If we look at ADP’s job numbers, they are mostly in the corporate sector. Large businesses with more than 500 employees accounted for 23.7% of the growth. Small businesses– the backbone of American economy- are comparatively stagnant. They accounted for only 8.9% of the total job growth in ADP’s recent report.

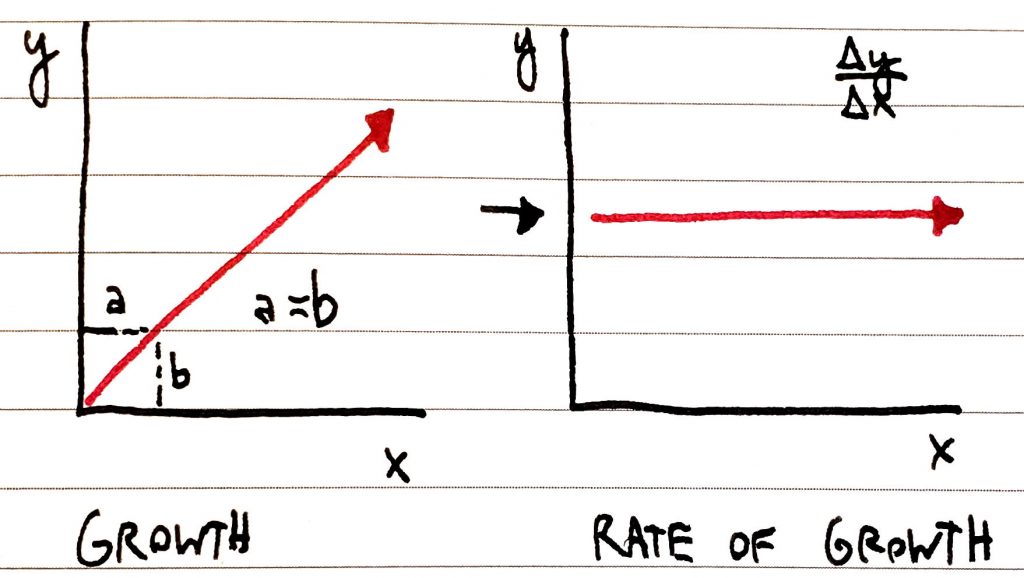

Job growth is a mathematical thing. Let’s go back to high school calculus, thinking about rates of change. When they say that the US economy created [x] number of jobs in a given month, one must remember that the economy has to create jobs to maintain employment levels. People have babies. The population grows. So, jobs have to be created.

Numbers from the Bureau of Labor Statistics, the slower but more comprehensive and authoritative source on the matter, confirm that the largest single chunk of jobs is being created by large corporations in recent years. Again– who’s getting the tax cuts?

That’s all fine in a period of economic expansion. But all expansions must eventually stop.

SO– ARE WE IN A BUBBLE?

Years of expansion and economic growth are pervaded by skeptical commentary, of course. Some are skeptical of growth in general. Prudent observers note that all of this growth in the past ten years has been quite expensively financed. (There’s another article coming about this specific topic!)

Every bubble is defined not just by growth of one major thing, but specifically by divergences of that major thing from some other major thing. It wasn’t just the housing market’s inflated values in the mid-2000’s– it was the growth of housing values and mortgage sales paired with the growth of default rates on those mortgages. In a global economy, a growing US economy will eventually crash if the Chinese economy crashes, and vice versa. These are two examples.

In this case, the divergence is perhaps best exemplified by the growth of a couple of companies while the rest of the economy falters or remains stagnant. Good metaphor for wealth inequality, right? It’s almost like this snapshot of the market is some sort of weird microcosm or synechdoche for the real thing! Two companies, Apple ($AAPL) and Microsoft ($MSFT), account for 14.8% of the gains of the S&P 500 in 2019. Amazon ($AMZN), Netflix ($NFLX), and Microsoft accounted for 71% of the gains in 2018.

Here’s what that is saying: Trump and the media are defining the health of the economy based on the stock market. And the health of the stock market is being defined by the success of two or three companies. Specifically, the capitalization of three companies is “worth” just under a fifth of US GDP. This is fueled as much by the stock market at large as it is by the media that hypes it. Trees will grow to the moon! Tesla will be a trillion-dollar company in no time! Reliance on a couple of monolithic entities? What could go wrong? Just ask Detroit!

To be clear, this is cause for concern by virtue of a lack of diversification if nothing else. Proponents and finance fanboys argue that Microsoft is a very stable company. It is comfortably able to cover all of its short-term debt. It has loads of cash and a diversified revenue stream. Amazon and Apple are financially stable and also have hoards of cash, though Amazon’s meteoric rise has largely been at the cost of margins. And it makes a lot more profit, margin-wise, off things like AWS than it does from its core retail business.

But in the case of any of these three– or any other leaders in the market- the house of cards doesn’t require a recession to fall apart. It merely requires a slowdown of growth. They call this an “earnings recession,” when earnings growth declines.

Let’s return to the calculus lesson. Much of our approach to measuring economics involves the assumption that growth is constant and positive– we take an upward trend curve and make it flat so that flat, indicating growth– ∆y/∆x, if you will- is the new normal. The job growth example illustrates this. So, stock price maintaining its growth is dependent upon sales growth. This was all well and good for Amazon, Apple, and others for the past few years. There doesn’t need to be a decline in sales, there just needs to be a slowdown. What will cause it? Could a viral outbreak in China catastrophically disrupt Apple’s supply chain? More likely than not, it’s a simple matter of mathematics.

Last fall, analysts suggested that investors were sitting on enough cash to drive up market valuations by 6-8%. That was, as I figure it, around 11% ago. Short-term prices of derivatives, which gauge investor sentiment about the possibility of near-term spikes or crashes, have bounced around quite a bit, ranging from historic lows last fall to brief surges when something spooks the market. This is measured by, among others, the CBOE Volatility Index, or VIX. It is currently about 35% higher than its most recent all-time low, and 40% down from its most recent highs.

In other words, there’s been a lot of speculation over the past twelve months about whether the market is going to blow up or not.

RIPPLE EFFECTS

The unfortunate truth is that there’s always a sequence of these things. The first element is that earnings growth slows. Second, earnings growth stops. At this point, companies stop being able to finance and refinance debt. They stop being able to financially tread water in an increasingly deep pool of debt whose bottom is ever farther away. This is the biggest single threat facing companies that have used tens of trillions of dollars of debt to grow over the past decade.

The federal government isn’t much different, with Trump having ballooned the deficit he pledged to eliminate. The national debt has more than doubled in a decade, and has increased by trillions under Trump alone. The Fed has virtually no runway to cut major interest rates, something it could normally do to stimulate lending. Though it has pumped a hundred billions of dollars into overnight lending markets to stabilize squeezed financial institutions. (That there is a squeeze when the economy is supposedly booming should be concerning– but no one is really talking about it).

The market peaks are a good bellwether for the idea of a tipping point. When earnings slow down, companies will have to shrink their balance sheets, and this means that workers are going to lose their jobs. How does that play into electability? If it happens in 2020, it can’t happen soon enough for the democratic contenders for president. But here are two opposite assertions that I am 100% sure are true:

- If the stock market stays this high, Trump will be reëlected.

- If the stock market crashes, Trump will take the blame and lose reëlection.

I hesitated to add a third assumption that the market will certainly crash this year. “You’ve been saying that the market’s going to crash for years,” three of my readers said to me separately. It’s true, though we have had near-bear-market downturns in between now and then. I’m not alone– perennial downer, investment legend John Hussman said that a 67% downturn sounded unlikely in 2000 and 2007, too.

To be clear, I’m not hoping for a crash (though, in the interest of disclosure, it wouldn’t be bad for my conservatively allocated finances). Rather, I am simply explaining that trees do not grow to the moon. And I’m cautioning everyone to be extremely skeptical and cautious of the current capital climate in this country– and prepared for when it comes crashing down.