Detroiters Grapple With Questions of Energy Future

Yesterday evening, concerned citizens, activists, and energy professionals packed a lecture room at Wayne County Community College in downtown Detroit to offer public comment to the Michigan Public Service Commission. The hearing was on utility DTE’s proposed Integrated Resource Plan, which it is required to submit to the MPSC, a proposal outlining– you guessed it- its unflagging affinity for fossil fuels.

While a few supporters showed up to cheer DTE doing a great job of investing in communities and something something, the majority speakers complained about the company’s failure to commit to meaningful efforts to curb climate change, the issue of widespread pollution resulting from reliance on fossil fuels, and the need to provide safe, reliable, clean power for future generations. Power equity as well as reliability was an issue raised, as ratepayers in the hood often struggle with frequent blackouts, bizarre billing issues, and shutoffs. Remember that time DTE CEO Gerard Anderson was so offended by accusations of unreliability that he took to Crain’s to defend the virtues of his company (Anderson, in the process, inadvertently self-owned when he conceded that a major storm that had knocked out power for six hundred thousand customers had knocked down twenty times more power lines than was expected).

The last time I was in WCCCD was actually to attend the IRP forum, where a large, bearded man identifying himself as a DTE engineer in charge of implementing large capital projects, told me about how climate change is a liberal lie and we desperately need natural gas to fulfill our needs. Fracking? Concerns about safety are overblown, he told me. Carbon dioxide? Not as big a deal as the doomsayers are making it out to be. But let me tell you about how the one winter, it was so cold that we almost ran out of natural gas, which is why we need to invest in better natural gas infrastructure. In addition to uttering a number of flat-out untruths, the dude was mostly just kind of, well, unimaginative.

This is how DTE operates as a company– unimaginatively. Is it their fault, though?

Well, yes, mostly– but not entirely.

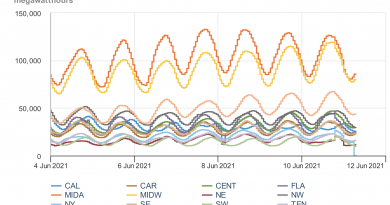

In terms of their place in the market, investor-owned utilities, or IOU’s, are odd beasts indeed. Investors view them as safe, stable, long-term bets owing to their uniquely monopolistic nature and the relative inelasticity of demand for their services. Everyone’s gotta turn on the lights at night and everyone has to heat their homes in the winter. Utilities have predictable balance sheets: their capital expenditures, though massive, are limited in number and frequency and planned out years in advance, utility rates are set by public mandate, and demand is predicted with reasonable accuracy based on weather patterns and population growth rates. The major risks to a utility are commodity prices for gas and coal, which can spike tremendously during a cold snap or a heat wave.

Utilities begrudgingly accept relatively limited regulation in exchange for this monopoly; if true “deregulation” were to occur and, say, microgrid and distributed generation solutions were to crop up on every corner, large IOU’s might well lose a double-digit percentage of their revenue potential overnight. But their continued existence, at least in the short term, is necessary for one reason and one reason only:

Baseload generation– the electricity that must be generated 24 hours a day to ensure that the grid is stable and can meet demand as peak demand fluctuates- cannot at this time be provided by renewable resources in most geographies. Solar panels produce power during the day and wind power produces more at night, and demand is, inconveniently, configured in opposition to this, a trend utility nerds call the Duck Chart. While there are multifarious ways to normalize demand over the day (realtime pricing and a lot of complicated stuff I don’t need to get into), we aren’t quite at the stage of being able to economically store enough power. It’s coming, don’t worry (the Tesla Powerwall is perhaps the best known example). This is the only reason why we still have massive coal power plants and nuclear power plants, which can produce a ton of power at a very low marginal (per kilowatt hour) cost.

Being able to do one thing very well and have a customer for it leads to predictability. But while predictability may inspire suits in banks to offer favorable rates to finance massive capital improvements, it is at odds with innovation or dynamism. Simply put, utility companies are, to the stock market, well, boring. They’re viewed as a safe bet to the point that equity outflows from risky companies like Amazon or Netflix go into companies like DTE as “safer” investments before they go into lower-yield treasury bonds, considered to be the safest investment. To give an extreme comparison, if DTE were valued at the same price-to-sales ratio as Beyond Meat, the new fake meat startup and darling of the IPO market right now, it would be worth more than Amazon, Microsoft, or Apple. Such is the folly of investment logic– safe is boring, and exciting is a great way to lose your ass.

Investors believe that because cash flow from operations is limited by regulated rates that their companies are intrinsically limited, too, in what they can profitably achieve, and the utilities have come to believe this as well.

But while the heavy tethers that keep DTE close to the ground spell stability for a risk-averse investor, they don’t mean that the company isn’t wildly profitable. Especially as we enter an increasingly unpredictable era of climate– not to mention a highly risk-prone global energy market, where oil is both on the wane and also threatened by geopolitical upheaval– it is time to get creative about what companies like DTE can do with that money.

But while a utility isn’t a charitable foundation, which is mandated to spend a specific number of dollars per year on philanthropy, neither is it governed by the same manic growth fever as exciting startups like Netflix or Amazon.

Embedded in the security of a utility’s economic might is the implied, but rarely realized, ability to do interesting, profitable things with that extra money.

Embedded in the security of a utility’s economic might is the implied, but rarely realized, ability to do interesting, profitable things with that extra money.

DTE paid no taxes last year on a record-breaking, more than billion dollars in profit. Through its IRP, it’s pushing natural gas expansion. Its commitments to energy efficiency (or “waste reduction” as One Tough Nerd once called it), are gestural.

What could that money be used for? Some ideas:

- Photovoltaics to power tens– if not hundreds- of thousands of Michigan homes

- Improving the electrical grid so that it is more resilient and better suited to handle distributed generation, microgrid solutions, and electric vehicles for the next generation

- Develop EV charging infrastructure

- Developing platforms to scalably retrofit existing housing stock, multifamily buildings, and commercial buildings with better building envelopes, more efficient heating equipment (eliminates the need to plan and finance multi-million dollar capex years down the line for the utility, improves health of workers, increases free cash flow for residents and businesses alike)

- Developing territory-wide renewable generation to supplant the eventual closure of the old-school Fermi nuclear plant near Detroit

- Developing next generation nuclear technology to provide reliable baseload generation for future generations (don’t @ me, I’m just saying)

If they didn’t want to do these things themselves, they could also invest in companies pioneering new solar technology (or other energy solutions). Excepting Tesla, purveyor of Powerwalls and solar shingles, supposedly (NASDAQ:TSLA), solar companies typically trade at a heavy discount, because investors think they are risky (this article kind of covers it). Utilities are not risky. There are only a few dozen– but not a few hundred- in the entire country. So, companies aren’t really competing with each other for market share, they’re just doing their thing to stay afloat and happen to make a bunch of money in the process.

What if utilities invested in solar companies to develop next generation solutions for carbon-free power grids? Indeed, what if pigs sprouted wings?

Coulda but did’n’a– and likely will not. What DTE did do instead was up its dividend payout to investors— a decision made just before it petitioned the MPSC to raise electricity rates. Because they lack the imagination to revolutionize the wild world of energy. Of course, the MPSC’s hands are largely tied, because, though it is responsible for hosting events like last night’s public comment session, any demands placed on the utility could elicit pushback in saying that “higher rates would be required to achieve [x].” Because that would either be demonstrably false or, at the very least, horribly disingenuous, changes would have to come via legislative or executive mandate.

Michigan Governor Democrat Gretchen Whitmer’s current deadlock with a Republican legislature is evidence that any changes would necessitate a great deal of headbutting.

This critique is not to demand that a company stop making money– that is, quite explicitly, its only purpose- it’s rather to suggest that maybe the company just stop being, well, so boring.