ERCOT Is Working Exactly As It’s Meant To. That’s… Kinda The Problem.

While the up north suffers from poor air quality from ongoing wildfires in Canada, the south is suffering from a historic heat wave. If you said, “hey, sounds like these things are happening way more than I ever remember them happening in the past!”– well, you wouldn’t be completely wrong. The problem with Texas, though, is that the state’s independent power grid, ERCOT, is simply not able to handle this heat. And this is showing up in the form of market failures and surge pricing for power that is driving up the wholesale price per megawatt by five or tenfold. The problem, though? It’s working exactly as it’s intended to.

Recap: ERCOT, The Lone Star Power Grid

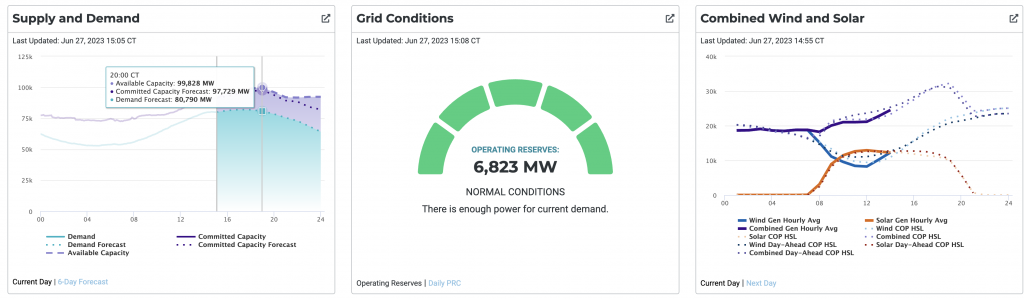

Texas, you may recall, has its own power grid, the reasons for which are complicated (and frankly stupid). You also may recall that in February 2021, the state faced a historic cold snap that nearly broke the grid. Power grids operate based on the nearly instantaneous production and consumption of electricity. When we talk about a grid collapsing, it’s a scenario in which supply and demand are so mismatched that it stops becoming a matter of volts, watts, and amps, and starts being a matter of frequency (Hz). This is obnoxiously technical, but ties back to the speed at which the magnets in the turbines actually spin, a process that is constantly moderated by a combination of computer and human inputs. If they’re not spinning at the correct speed, the power grid will stop working.

This happened in February 2021 in Texas, although it wasn’t as bad as it could have been, and the grid didn’t completely collapse. (Mexico even helped out the Lone Star state during an energy crunch in 2011, but we don’t talk about that). A couple of years later, though, the state faces triple-digit extreme temperatures, and the grid is strained to the absolute max. Beyond the strain and the prospects of a complete collapse (read: many people would die and critical infrastructure would stop working), the most insane thing is what’s happening to customers caught in the mess: They’re having to eat the bills for the grid’s realtime pricing setup. And that’s part of the problem, because it means that the grid is working exactly as it’s intended to work.

“Mr. Market Knows Best“

The headline is a quote from a guy I used to work for who probably belongs in jail, but I have to say that I just love the idea of “Mr. Market.” In a market economy, goods are typically priced based on the intersection of the supply curve and the demand curve. In a competitive market, you have something that someone else wants, and they pay you a fair price for it. The more competitive the market, though, the profit margin is driven toward zero. However, in a restricted market– like Texas’ power grid, for example, in which the state effectively prohibits importing or exporting power by forcing everyone into a monopoly power grid operator– a supply crunch or a demand spike will mean that prices are going to go through the roof.

This basic logic is intuitive to the average consumer. But the problem with power is that consumers in most markets have come to take for granted the notion that power shouldn’t cost any more or less based on when you use it. If you look at the power generated by a nuclear power plant, for example, the load generated is completely flat– it doesn’t increase or decrease, unless a unit is shut down. Coal plants can modulate capacity to some degree, and natural gas power plants more so. Solar power is fixed based on where the sun is, but it’s predictable. Wind is less predictable and less fixed, but it operates roughly inversely to solar, peaking at night rather than during the day.

Transitioning to renewable energy– something most experts agree is vital if we’re going to decarbonize our society (if you believe in science– we here at Handbuilt City do believe in science)- means that we need to figure out how to smooth out the loads across the day and across several different power sources. This currently includes nuclear, fossil fuels (gas and coal, mostly), photovoltaics, wind, and hydroelectric. (There are other power sources, but these are the biggies). The fastest way to do this is with time-of-use pricing. DTE just implemented it here in smoky Michigan, and we are suddenly paying around a quarter per kilowatt hour, which is something I will have to find another time to issue a vitriolic rant about.

Consumers vs. Producers vs. The Government

ERCOT is presently facing what we in MBAland might refer to as a “market failure.” The grid is still functioning. And so is the market! It’s functioning so well, in fact, that the wholesale retail price for electricity has spiked as high as ten times its normal rate. In an interconnected grid, the local grid operator would be able to buy power from a neighbor. In Texas, though? Can’t, because freedom. Energy producers in the Lone Star state have pointed out problems with this in recent months, mentioning that ERCOT’s own estimates for demand have occasionally been pretty far off the mark. It gets even better when you look at the price per megawatt of things like utility-scale solar or newer wind turbines, which are able to deliver power not only cheaper than fossil fuels, but at an infinitesimal rate to these market-driven peak prices.

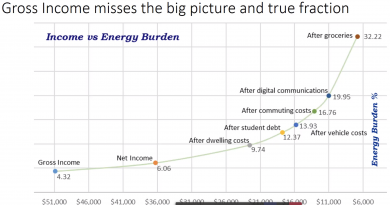

In a market that operates as this one does– restricted by government mandate and subjected to extreme price swings- the cost is either passed onto the consumers (saving customers money on a good day or quite literally bankrupting them during an extreme weather event), onto private companies (incentivizing innovation on a good day, facilitating massively risky investment and speculation on a bad day), or onto the government (of “fiscal responsibility,” no less, which touts free markets and “freedom”).

What’s going to happen is anybody’s guess, but the best solution is probably one that involves the ability to interconnect with other producers. Other things that might be good could be balancing the state’s burgeoning wind supply with demand from its neighbors, and then selling off excess capacity as needed. Solar and wind in Texas are only growing, but there’s a limit to how much power you can produce and consume locally– even in Texas.