Debt or Asset? How Utility Shutoffs Are About To Be A Big Problem.

The AP reported yesterday that up to 37 million households will be facing utility shutoffs as shutoff moratoria expire. Some napkin math shows that of the roughly $27 billion in delinquent debts, the current stimulus allocates around $9.1 billion to address that. But all of this goes to LIHEAP. As I’ve written before, most LIHEAP money, nearly literally, goes up in smoke. It could be used to reduce carbon footprint and reduce costs, but this would require some structural changes. This leads us to a fun finance question. (Aren’t all finance questions fun!?). Can’t this debt simply be, well, cancelled?

Debt 101

Debt is a great way to illustrate the “double-entry” bookkeeping system that effectively birthed Western capitalism several hundred years ago in Italy. (There are some disagreements about who actually invented it– some say it was the bankers of the Medicis. Others trace the system back to medieval banking). Simply put, if I owe you $100, that represents a liability for me. But it represents an asset for you. Because, at least theoretically, you have the ability to collect that debt. For you, this would represent an account receivable.

As accounts receivable get farther away from their intended time of collection, accountants “age” them. This means that they are less and less likely to be collected. The account is, in turn, written down. This is why it is possible to “cancel” medical debt by buying it up at a fraction of its stated amount. The funny thing is that the hospital that billed you $100,000 for getting a new arm, or whatever, never actually expected to have you pay all of that money.

The Argument For Cancelling Debt

Liberals will often approach the question of debt cancellation as a fundamental matter of equity. All student debt should be cancelled! The COVID Jubilee! But without graduated scales, how is this equitable? Rather, I propose looking at the issue by way of promoting consumer spending. If I’m making $200,000 a year, I’m probably pretty comfortable. If I have $200,000 in student loans, though, I’m definitely less comfortable. But if someone cancels my $200,000 in loan debt from my Harvard Business School degree, am I going to spend all of my extra income? Economic studies show that, well, probably not. After all, me upgrading from my salvage title Chevy Aveo to a Mercedes G-Wagon doesn’t do much to help the economy.

Know what would, though? Cancelling Joe Blow’s debt from down the block. Because if he gets his debt cancelled, he’s going to spend that money. He’s probably going to spend that money locally, too. The student debt question is, as they say, a whole ‘nother level. But this seems to make as much of the case for cancelling a portion of delinquent utility debt. There’s a lot of evidence that utility shutoffs specifically have disastrous economic effects.

The Arguments Against Cancelling Debt

Arguments against cancelling utility debt? Well, it depends on who it comes from. Talk to the customer service person and they’ll tell you that well, sorry, bucko, this is what you signed up for! Or, my favorite one– the charges are valid! It’s all there, clear as crystal! Fax mentis incendium gloria cultum, et cetera, et cetera! Nah? Okay. We can’t fault the customer service people. They get paid to say this!

If you ask the financial highers-up, though, the argument is more nuanced. Companies often balance uncollectible debt with additional interest and fees assessed on collectible but delinquent debt. This is why debt consolidation companies or credit cards will charge different rates of interest to different people with different credit scores. Debt, like any investment, can be diversified. In other words, utility companies derive a portion of their total revenue from being able to assess late fees or interest (if that is allowed). Utility shutoffs, too, usually result in a hefty, multiple hundred dollar reconnect fee. Of course, there’s also the issue that utilities are beholden to not only ratepayers but also shareholders. (One wonders what we’d have to do to move beyond a system that requires assessing predatory expenses to poor people).

Conclusions

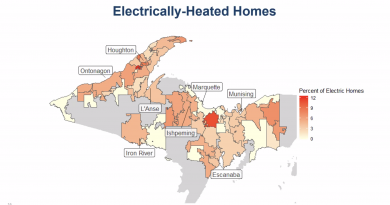

To be clear, utilities have a right to make money insofar as any private company has a right to make money. But there are ways that we can all have our cake and eat it, too. Like I wrote in the LIHEAP piece so many moons ago, we need to spend more money investing in making housing more energy-efficient in the first place. This doesn’t even have to threaten the utilities’ profitable and captive market of ratepayers.

Utilities can themselves invest in these programs– for a return, even. Energy efficiency investments always pay off. Hopefully the coming, you know, trillions in new stimuli will address this. But it’s up to us to make sure we get beyond just subsidizing utilities. This is what’s happening with ACA subsidies in the latest stimulus. It’s not sustainable. What would be sustainable? Investing in quality housing.

We reached out to Dr. Tony Reames at the University of Michigan, who studies this stuff, and to DTE. We will update as we receive responses.

This article is part of a series on infrastructure. Join the ranks of the few and the proud and support independent journalism!