Dan Gilbert Juggles Tenants, And Taxpayers Are On The Hook.

Kirk Pinho, from Crain’s Detroit Business, has been bringing us the latest about downtown Detroit real estate. Pinho has provided comprehensive coverage, but, ever true to Crain’s mission of toeing the corporate line at all times, there’s a lot of conversation about business transactions and very little conversation about the project economics. Such is the case in the Hudson’s Site to which, Pinho just announced, more Gilbert companies are relocating:

Dan Gilbert’s family office, Rock, as well as the Gilbert Family Foundation, are moving into Gilbert’s newest development in Detroit. Both offices are moving from the One Campus Martius building to the seventh floor seventh floor of the 12-story office and event space building, a spokesperson for his Bedrock LLC real estate company confirmed.

What it amounts to is that Gilbert has been relocating tenants from older or perhaps less desirable spaces to the shiniest new jewel in the crown. The problem? Taxpayers are on the hook for both the old buildings and the new one, and the net job creation numbers at this point are approximately zero (if not in fact negative). The job creation pitch– which was what was used to sell a city council that effectively has always been in the thrall of both Mike Duggan and Dan Gilbert- advertised as many as 2,000 permanent jobs that would be created from the project.

So, it leaves us wondering– how many jobs are being created? And how much public money is being used to subsidize the whole endeavor? TLDR: We don’t really know either figure, and probably won’t. Tom Perkins has written about this, as have I in the past. A colleague, who is an economic development veteran and longtime Detroit resident, dismissed my concerns over what they called the “silly little jobs component” (their words) as something that was just necessary to get funding for a project that would have otherwise never happened.

“We Must Take What We Can Get, No Matter The Cost”

I don’t buy this “we must take what we can get” thinking because it is, at best, excrement. We need to put silver bullet thinking to bed.

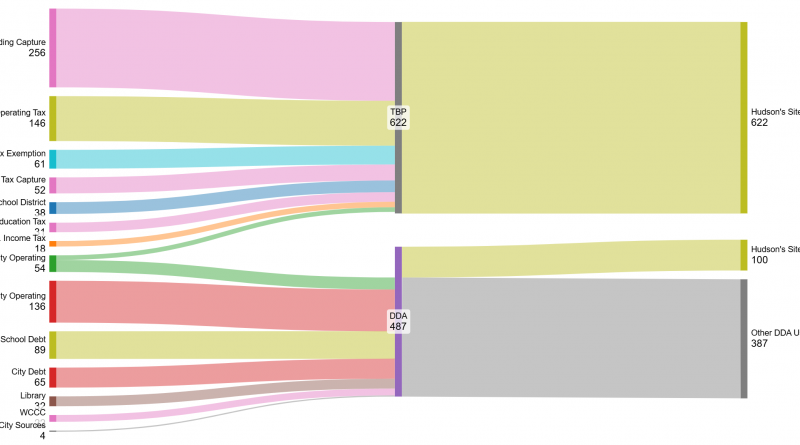

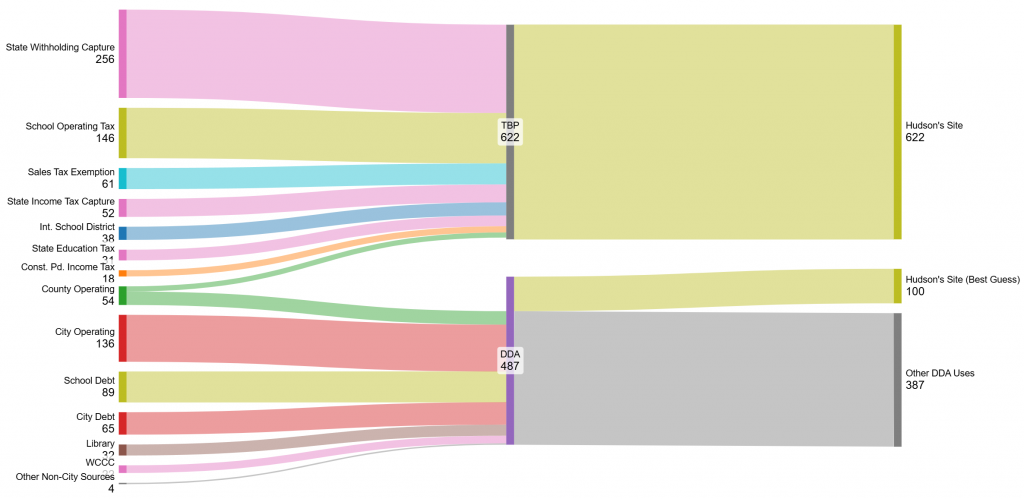

I dug up a bunch of numbers and put together a best-guess estimate. Here’s where it gets really confusing. The Downtown Development Authority, a quasi-public, but mostly privately operated, development entity, has a broad set of powers at its disposal to direct various revenue streams. The “Transformational Brownfield Program” tax credit, a corporate subsidy state legislative tool tailor-made by Gilbert’s own lobbyists, allows a similarly broad range of vehicles to be used to funnel public revenue sources into private development subsidies.

Pinho cites a $618 million subsidy figure, which is close to the $622 million I came up with, but there’s an additional $100 million (very ballpark figure here) that could come from the DDA. The legibility problem here is that the DDA and the TBP aren’t entirely transparent about sources and uses, and a lot of these deals involve bundling. It’s not clear to me– as a city planner who has spent years working on this stuff, ranging from the spreadsheets of real estate finance to the literal bricks and mortar of adaptive reuse and historic preservation- why we are even allowed to call an exorbitant downtown parcel of land as part of a “brownfield.”

The “Other DDA Uses” is where it gets a bit confusing, because the DDA has a broad (and controversial) authority to basically commandeer public sources of revenue to spend on, well, whatever. We often don’t know, and we often can only find out by way of litigation (more on this in a minute).

Brownfields are supposed to be big industrial sites that “need” incentives to turn them from asbestos mills or DDT factories or what have you, into productive, “clean” uses. Recall that– as I reminded my ED colleague- developers talked with googly eyes in the mid-2010s about how they wished residential rental rates would edge up above $1 a foot. They also said that once residential rental rates were $2 or more a foot, they wouldn’t need public subsidies anymore.

Well, I guess we see where that went.

It’s fairly clear that I am in the minority opinion here– and certainly one of a tiny minority actually interested in voicing opposition to such preoccupations with Reaganomic thinking. Is it just part of our society’s glorification of wealth? As a Detroit taxpayer and as someone who worked for the Duggan regime, I can tell you that downtown’s gotten a lot nicer in the past ten years. What hasn’t? Bus service (still atrocious), street cleaning (streets are filthy), infrastructure in general (constant flooding). The air is still dirty and the taxes still keep going up and up every year. And while the city offers lavish corporate welfare deals to Dan Gilbert, the Ilitch Consortium, and even to the noted criminal enterprises of the Moroun clan,

JC Reindl, who also excels in posting these “it is what it is” characterizations, is even writing about the Free Press suing to obtain access to records regarding the project. Reindl’s article also cites a study from the University of Michigan who says that the project is estimated to pay off the cost of the public subsidy– by 2052. However, Reindl also notes that these numbers seem to fail to take into account the fact that Rocket Companies have slashed their workforce by about 40% in the past several years. My ED colleague calls me a “hater” for my asking these questions; I call it a vital question of accountability.

But what do I know? I wouldn’t have demolished the old building in the first place.

In the interest of disclosure, the Mackinac Center for Public Policy, which is assisting in the Freep lawsuit, shares a board member with Abundant Housing Michigan, a non-profit organization of which the author is also a board member. Neither the author nor AHM have had any involvement whatsoever with the litigation or with the Mackinac Center itself.